We explain how the stock market works considering an analogy with the real estate. We define concepts such as the initial public offering, the book order, the shares, the stockbroker and the liquidity.

We explain how the stock market works considering an analogy with the real estate. We define concepts such as the initial public offering, the book order, the shares, the stockbroker and the liquidity.

What is the stock market? What is the stock exchange? How do they work? What are the shares? And what determines the price of them? To answer these questions we are going to make an analogy. For that, let's consider that you own a condominium made up of 15 houses. How much is this condo worth? To know it, we must know, for example, how many bricks you used, how much time it took you to build it, in which residential area it is located, and so on. A company is similar to a condominium, you build it and it acquires a value depending on how much you have invested in it. Since you want to make money with the condominium, you will try to sell the houses in it, obviously not all of them because if you do so you lose control of the condominium because you would have lost all the entrance keys. Something similar happens with the companies, in this case what is sold are the shares. In contrast to the houses, the shares are symbolic, they are not objects that you can touch, they simply represent the value of a company. If your company is valued at one million dollars, you can assign to your company one million shares, which means that each share is worth 1 USD. Here we can construct our analogy: "A company is like a condominium, in the same way that a share is like a house."

There are two types of companies in the world: public and private. If your condominium would be considered a private company, then only you have the entrance keys and you won't let in anyone that you don't like; therefore, the houses that you want to sell will only be offered to your investor friends. If this is not enough, you will choose to sell them to the general public, that is, you will become a public company. When we talk about houses, the usual thing to do when you want to sell one, is to publish an ad in the newspaper and wait for someone to contact you back. When we talk about shares, you don't place an ad in the newspaper, if you want someone to buy your shares you must place them on the stock exchange, which is an entity (or a marketplace) dedicated to the purchase and sale of shares. Every country has at least one stock exchange and the collection of them is what we call a stock market. Each stock exchange has a cumbersome procedure to be accepted in it; therefore, it is not quite straightforward to become a public company. The good thing is that you can choose the stock exchange to which you want to belong. Let's assume that you want to be part of the Paris Stock Exchange, and to make it simple, let's consider that you are easily accepted in it, then the day comes when you officially offer your shares to the general public, this first offering is called the initial public offering (IPO). We are going to consider, just to make things clear, that your condominium is part of this financial adventure, however, you must keep in mind that it is not a condominium but instead a company and its shares that are part of the stock exchange. We initially said that you have 15 houses, so you will have 15 shares in total. Table I shows us a summary of your initial public offering:

As we can see, you are choosing to keep 9 houses. Why? Because if in the future you want to make any change to the condominium (or rather to your company), you can impose your decision because 9 out of 15 represents the majority. After another cumbersome procedure, the initial price of each share is set. In the case of houses, the base price is usually given by the municipality of your district, while for the shares of a company it is given by financial institutions. In this exercise we are assuming that your condominium is actually a company, then it is a financial institution that sets the price of each house, let's say that your condominium is valued at 3,000,000 USD, then, each share is worth 3,000,000 / 15 = 200,000 USD. In the stock exchange it is very rare to find shares with such huge unit prices, here we are making an exception to ease the explanation.

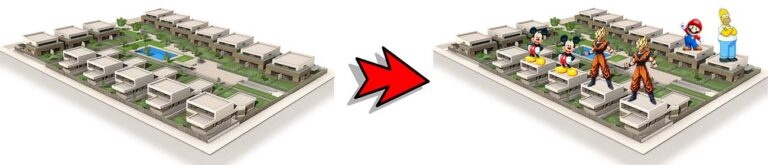

Let's consider that the 6 houses that you put up for sale are sold on the first day (the day of your initial public offering). As you can see in Fig. 1, Goku and Mickey have bought two houses each, while Homer and Mario only one.

They bought these houses at the price of 200,000 USD. This money goes to your pocket because those houses were yours. Then in your initial public offering you made 200,000 x 6 = 1,200,000 USD, but this is not the maximum value that you can earn because, likely, due to the demand of your houses, a new buyer will appear. Since you already sold the initial 6 houses, then the new buyer will make a higher offer to attract you or one of the new owners to sell a house. Let's say that this new buyer offers 250,000 USD for a house, what does this imply? That all the houses in your condominium have appreciated by 50,000 USD, implying that if you now sell the seventh house, you will earn much more. Don't you think this is interesting? The IPO is in fact an spectacular event for the owners of the companies. For example, when Bill Gates took Microsfot public, he owned 11,222,000 shares, and financial institutions had set the initial price to be 25 USD per share. On the day of the IPO, the price of each share reached the value of 35 USD because a lot of investors appeared and they were willing to pay even more. Doing the math, in one day Bill Gates made a profit of 35 - 25 = 10 USD for each share, giving him a surplus of 112,220,000 USD. In simple words, thanks to the IPO, Bill Gates generated more than 100 million dollars in profits in a single day. In general, thanks to the IPO, companies collect astronomical figures, and with this, if they wish, they can finance new projects in the company. The funny thing is that this is extra money that appears as if by magic because the company starts out having a value and thanks to the sale of shares it dramatically increases that value, but what's the catch? It looks so easy to create shares out of thin air and sell them for huge sums of money. To understand it, let's see Fig. 1 (right). As you can see, there are new owners in the condominium, and that's the catch! Now you have partners, you are not the absolute owner, there are others who have the right to decide what to do with the condominium. The problem of going public is that if at any time you need more money, you will have to sell more shares, which could leave you with an ownership percentage below 50%, that is, you would no longer be the majority, another could take control of the company and change its direction. Interestingly, if you are a private company, it is easier to control this aspect because you decide to whom you open the doors and what are the rules to follow. The advantage of going public is that you raise funds quickly because there will be millions of investors on the stock exchange.

The question is: Why did Goku, Homer, Mario and Mickey opted to buy your houses? The answer is that they are convinced that over time they will be worth much more, that is, they are making an investment. Certainly, there are people who buy houses just to live in because is their dream, that is, they do not plan to sell them later on to make some profits. Shares, on the other hand, although they are not objects that you can use, if you decide to keep them, they can give you profits for the rest of your life. One way to do so are the dividends, which are fully explained in the article: "Make money with dividends. The secret." Another way to make money with the shares is to buy them at a given price and hope that in the future they will be worth much more so that you can sell them at a higher price. In this article we will focus on this second method and we will assume that Goku, Homer, Mario and Mickey bought the houses because they are convinced that in the future these houses will have a higher price. The reasons why they think that are personal, and these reasons sometimes may be wrong. Let's consider that on the same day of the initial public offering, a company X notifies to the city that it will build a mall near the condominium. This will likely raise the price of the houses, why? The answer is part of the real estate market and it is a topic that we will discuss in a future opportunity. For practical purposes we will say that the price of the houses will increase because everyone loves to live near a mall, and therefore, they could pay anything as long as they get a house nearby. In the previous paragraph we mentioned the possibility that someone offered 250,000 USD for a house, now we are going to say that in the second day, thanks to the mall news, someone offers 300,00 USD. Although the offering is 100,000 USD higher than the initial price, the owners, including you, consider that this price is still low for what the house is now able to offer. 2 owners decide to sell their houses at a much higher price. You, being the main owner of the condominium, can also choose to sell one of your houses, remember that you have 9 left and selling one would still give you majority. On the second day we are going to assume that 4 buyers appear, this is going to generate in the stock exchange what we call the order book, which is given in Table II:

The order book refers to an electronic list or table of buy and sell orders, the "order" column is associated with the individual. For example, in this case we have 5 buy orders and 2 sell orders, that is, 5 individuals want to buy a house and 2 want to sell it. Certainly, the same individual can generate multiple orders, but for practical purposes, in this example, we will say that this is not the case. The interesting thing about Table II is that although there are 2 sell orders, we do not know exactly who the individuals behind them are. It could be Goku, Homer, Mickey, Mario, or even you, this gives the stock exchange a level of privacy. The "quantity" column shows the number of shares to be bought or sold, for example, we see that there are 2 sell orders, the first one with one house and the second one with two houses. The latter means that one individual, and only one, is selling his/her 2 houses. All buyers and sellers have the freedom to put the price they want, the important thing here and what you have to know is that they all want to make a profit. In the "buy" column we have the prices at which the buyers want to buy the shares, e.g., there are 2 shares that want to be bought at the price of 3.0 x 105 USD. In the "sell" column we have the prices offered by the sellers. Let's assume that on day 2, Table II remains unchanged, i.e., there is no agreement between buyers and sellers. For a transaction to exist and be considered successful, the buy price and the sell price must be equal. Now we will say that on the third day this is exactly what happens, a new buyer appears offering 3.5 x 105 USD for a house. The transaction is then completed and the order book is updated as shown in Table III:

In Table II the share price was 2.0 x 105 USD. Even though there was a buyer offering 3.0 x 105 USD for a house, the share price was not updated to this value because it only becomes real if a transaction exists. In Table III we do have a successful transaction and that is why the share price has increased. Moreover, as you can see in the "quantity" column, now we have 1 share offered for sale at 3.5 x 105 USD. This contrasts with Table II where we had 2. The difference is because a 1 share transaction took place. Technically speaking, what just happened is a partial sale, because in Table II there was an order with 2 shares and then in Table III it became 1 share. It is partial because we know that here we are talking about a single individual (a single order) who wanted to sell his/her two shares and if he/she only ends up selling one, then the total sale has not been fulfilled; however, this will eventually be fulfilled when a new buyer appears offering the same price. This process of buying and selling shares is done in the stock exchange, who does it? The person in charge of this procedure is the stock broker. He/she will be aware of the book order and when he/she sees that there are matching values in the buy and sell columns he/she will approve the transaction, obviously nowadays computers help the broker to do this efficiently.

Probably, when you have seen charts of the stock exchange you have seen something similar to the following figure:

In this case we are considering the shares of Twitter, which are bought and sold on the New York Stock Exchange (NYSE). In its initial public offering (November 8th, 2013), Twitter began selling its shares at the price of 41.65 USD. As you can see, on September 04th, 2018, the share was valued at 35.18 USD. Why it changed? The answer is written in the order book as we have just seen. While in our example we had at most 5 buyers and 2 sellers, for Twitter there are thousands of investors. Every minute (or even every second) there is a successful transaction going on, therefore, the value of 35.18 USD in Fig. 2 represents the last successful transaction on September 04th, 2018. If you check this chart in real time, you will see that the share price tends to change constantly, this is because there are many successful transactions that are constantly altering the share price. Therefore, if we plot the share price versus time, we obtain a result such as the one shown in Fig. 2. What does the share price fluctuation depend on? Although it may sound strange, if you gather 1,000 people in a room and ask them if they think that Twitter shares will grow, you will see that on average half will say yes and the other half will say no, and the reasons will be diverse. If the share price of Twitter starts to grow, it means that there are more people who believe that this company will appreciate in value over time and they will not mind paying a little more. In this way, the stock exchange becomes a market where those who can predict the future or get it right efficiently will constantly be making profits because over time they will sell their shares at a higher price, but in order for someone to win, someone else must lose, and this has no end because we will always find people thinking in opposite ways, therefore, there will always be winners and losers.

To conclude, it is worth mentioning that just as the condominium only had a successful transaction on day 3, there are companies in the stock exchange with a similar behavior. These companies are usually called companies with low liquidity and it is recommended not to invest in them because then it will be very difficult to sell your shares. Let's look at the example of "O Sorbet d'Amour":

This company is listed on the Paris Stock Exchange, or at least it was listed when this article was written. Precisely, companies are usually delisted from the stock exchange if they have very low liquidity. As you can see in Fig. 3, from August 7th to August 13th, 2018, O Sorbet d'Amour did not have any successful transaction (similar to the condo that had no transactions until day 3), so its chart is a straight line planted in the value of 7.0 EUR. On August 23rd there was a successful transaction, buyer and seller agreed on the price, in this case the seller accepted the price of 4.5 EUR offered by the buyer (in the case of the condo it was the other way around, the buyer was willing to pay the seller's asking price). We will never know if the seller of O Sorbet d'Amour lost money or won, most likely he/she lost. For highly liquid companies like Twitter, in contrast, it's very easy to buy and sell your shares. Moreover, since there are many investors, the buying and selling prices are very close to each other. For example, if the share of Twitter is worth 35.18 USD at time t, one second later a buyer and a seller will appear offering, respectively, 35.17 USD and 35.19 USD for the share, two seconds later a third investor will appear who will take one of these two values, raising or reducing the price of the share in that small interval of time. In the long run, due to the high liquidity, the fluctuation is small, you can see this by looking at Fig. 2 where Twitter had a negative variation of 1.32% on September 4th, 2018. Something very different happens with companies with low liquidity, they usually have sharp changes in their share price, we call them companies with high volatility and we can appreciate one by looking at Fig. 3 where O Sorbet d'Amour had a positive variation of 7.44% on a single day. The curious thing about all this is that these fluctuations are constantly happening 5 days per week, and if you think about it, it's really fascinating how many people in the world are doing this every day... the only one missing is you and I think with this brief introduction you will be able to take the next step: "Steps to start investing in the US Stock Market."

Views: 1

Notifications

Receive the new articles in your email