We show how to open a TD Ameritrade account as a foreigner in order to start investing in the US stock market. This account will allow adults to make real-money investments and minors to do so with fictitious money. You will understand how to: i) complete the W-8 BEN form; ii) locate your Foreign Tax Identification Number (FTIN); and iii) install Thinkorswim.

We show how to open a TD Ameritrade account as a foreigner in order to start investing in the US stock market. This account will allow adults to make real-money investments and minors to do so with fictitious money. You will understand how to: i) complete the W-8 BEN form; ii) locate your Foreign Tax Identification Number (FTIN); and iii) install Thinkorswim.

A summary of this article with some extra info appears in the following video:

The stock market is a fantastic place that teaches us that money is simply a fluctuation because the quantity on the bill changes all the time. And what determines this change? Three factors: i) global news, ii) statistical data, and iii) trading fees, quite similar to those given in the article "How to make money exchanging currencies. The secret of forex."

First and foremost, if you are unfamiliar with the stock market, I recommend you to read the article "The stock market. A complete explanation for beginners." The first factor, global news, is referred to as the fundamental analysis factor, and its sources include, among others, newspapers, newscasts, and financial institutions dedicated to the collection of economic data. Most of these sources offer their services online, so the information is accessible to everyone. The second factor, statistical data, is referred to as the technical analysis factor, and its sources are quite similar to the previous one, but they focus mostly on the stock price vs. time charts. Finally, the third factor, trading fees, strongly depends on the stockbroker that you choose, or rather, on the platform that you use for your transactions. In this article, we will not delve into these three factors, but rather we will focus on the steps that you need to take to start this financial adventure.

If you are a minor, you can participate, but instead of actual money, you will use fictitious money. This will allow you to gather experience at a young age and step ahead of your peers. If you are an adult and have a source of income, you can invest with real money and thus be part of the financial world. In this article, we explain in full how to open a TD Ameritrade account, which will allow you to buy and sell stocks, futures, options, ETFs, and other financial instruments. TD Ameritrade is one of the many brokers that have access to the US Stock Exchange, we consider it because it is the most complete platform that we have seen. The given steps are only 6 and will allow you to access the US Stock Exchange without a US resident permit. To ease the discussion, we will consider as an example the case of a Peruvian living in Peru, however, keep in mind that the steps given here apply to many countries around the world.

Step 1

Write to starting@tdameritrade.com. The first step is to inform them that you want to open an account and if they can send you all of the necessary documentation. They must validate that your nationality and country of residency qualify you to join TD Ameritrade. If you are a minor, you must create an account under the name of your parents, or better said, they should be the ones creating an account for you.

Step 2

It may be ok to attach these copies in the original language. To be sure, please ask TD Ameritrade. Details on how to fill out the forms appear below. Click on the corresponding form:

Step 3

Send the documents to TD Ameritrade. If you are not allowed to register online, you can submit your application i) by post mail, ii) by fax, or iii) by email. Note that restrictions apply depending on your country of residence. Request the proper information to TD Ameritrade.

Step 4

Activate your personal account. Once they receive your documents, it will take a week for you to receive a confirmation email saying that your account has been accepted and that you will soon receive a welcome letter by post. This letter will have the following information:

- User Number: 123456789

- PIN: 1234

Because the letter may take several weeks to arrive, it is best to call them by phone as soon as you receive the confirmation email. Their phone services are available in English, Chinese, and Spanish. I recommend that you download Skype on your computer or phone because it allows you to contact them at no cost. When you talk to them, you will ask them about your user number and pin. Keep in mind that this is a service call, so it could take up to an hour for someone to respond. Fortunately, because it is a free call, you should not mind leaving the phone ringing while you do something else. Once they respond, they will ask you some questions to confirm that you are the owner of the account; these questions will be based on all of the information you provided in the forms you submitted. If your answers are correct, they will give you the user number and the pin, which you will enter on the login page of TD Ameritrade, i.e., as seen in Fig. 1, you type the user number on the "User ID" field and the pin on the "Password" field. Then you click on "Log In."

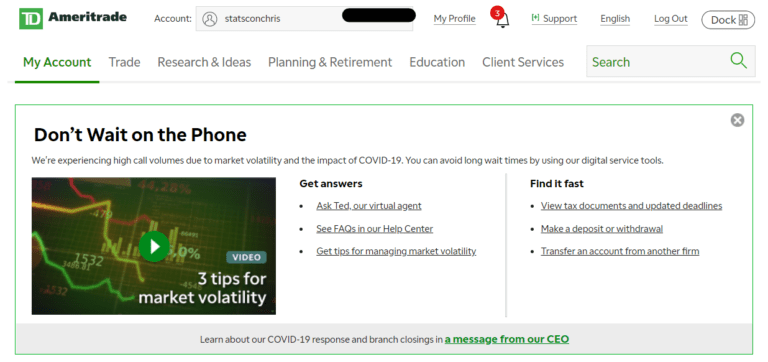

TD Ameritrade will notify you that this information is not a valid "User ID" and is instead the number used to activate your account. You will be taken to another window where you must create a username and password. After you've created them, return to the login screen (Fig. 1) and enter your newly created username and password. This will grant you access to your TD Ameritrade account, which should look like Fig. 2.

Step 5

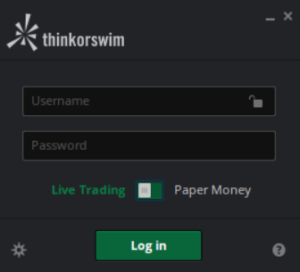

Install Thinkorswim. TD Ameritrade is a fantastic platform in and of itself; for example, as shown in Fig. 2, there is an education section with video lectures where you can learn all about the stock market for free. Nonetheless, by installing Thinkorswim, you can take your personal account to the next level. This is a TD Ameritrade add-on platform that can be installed on your computer or your mobile device. When you open it, you will be requested to enter your credentials, see Fig. 3.

Your username and password are the ones that you previously created when setting up your TD Ameritrade account. As shown in Fig. 3, at the bottom of the login screen, you can choose between "Live Trading" and "Paper Money." The first one is for real-money investments, and the second one is to practice with fictitious money. Precisely, the second one is ideal for minors and individuals who are interested in the stock market but would like to practice first without risking real money. What is important to remark is that you don't need to have money with you during the registration process; that is, you can create an account and have access to the tutorials and Thinkorswim without paying or depositing any money.

Step 6

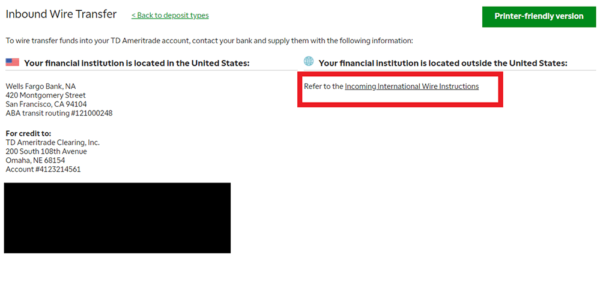

Transfer money to your personal account. Finally, in order to invest in the stock market, you must first fund your personal account. If you don't live in the United States or have a bank account there, your only choice is to wire money overseas, which means transferring funds from your local bank to your TD Ameritrade account, and for that, you would have to pay a fee. This fee ranges from 30 to 70 USD, depending on your country, the bank, and the amount you want to transfer. Banks in Peru, for example, normally charge 30 USD for transfers to the US of up to 3,000 USD, and 40 USD for transactions of 3,000 to 10,000 USD. In this respect, if you live in Peru and want to transfer 300 USD, it is inconvenient since the bank would deduct 30 USD, meaning you will lose 10% of your capital in the transfer. Consequently, in this case, it would be prudent to move at least 3,000 USD, since you would only lose 1% of the total amount. Below I show you the steps that you must take from your personal account to view the TD Ameritrade bank account information. To make an overseas transfer, you must provide this information to your bank:

Keep in mind that your bank account must be in dollars, or you will lose money on the currency conversion. To conclude, I can only say: "Welcome to the financial world."

Views: 1

Notifications

Receive the new articles in your email