We share the 6 most important technical differences between the stock exchanges of Japan and the United States. Moreover, we show how the customs of a country could have an impact on the share price.

We share the 6 most important technical differences between the stock exchanges of Japan and the United States. Moreover, we show how the customs of a country could have an impact on the share price.

A summary of this article with some extra info appears in the following video:

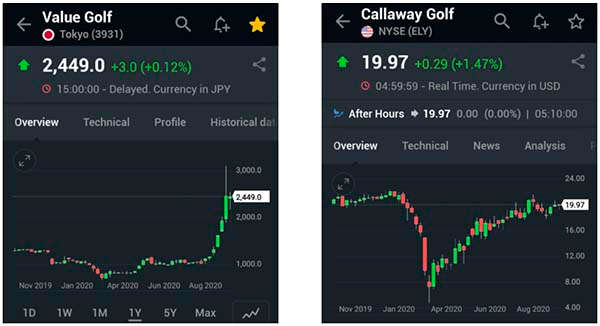

I personally think that the stock market of a country, besides reflecting its economy, captures the essence of its customs. Certainly, I realized this when I began to invest in different stock markets around the world and understood that the investment strategies that I used in the West were not applicable in the East, or those that I took for granted in the North were no longer valid in the South. As an example, with the COVID-19 pandemic, which lasted throughout 2020, the following charts give an idea of what I'm trying to convey:

If we consider a ranking of the most popular sports in the US, we would have American football on the podium, followed by baseball and basketball. If we do the same in Japan, we would get baseball on the podium, followed by soccer and golf. You may disagree with the ranking given here, but what is certain is that golf is more popular in the land of the rising sun than it is in the US. And because of this we see in Fig. 1 how Value Golf, which is listed in the Tokyo Stock Exchange, had a dramatic growth during the year 2020, while Callaway Golf, which is listed in the New York Stock Exchange, at most recovered its pre-pandemic value. This is a clear example of why when you invest in a country it is important to understand its customs and its psychology in order to capture the differences in advance and make greater profits.

In this article I will share with you the 6 most important differences between investing in Japan and investing in the US. I won't go deeper on the psychological aspects of a society because that's a very extensive topic. Instead, I will focus on the technical aspects, which are also relevant when making an investment.

1. Companies listed on the Japanese stock market are identified with numbers, while those that are listed in the US are identified with letters

Although all the public companies listed in the world have an international number called ISIN (international securities identification number), locally they have a more practical identification. As an example, consider Fig. 1 where Callaway Golf is listed with the code ELY, while Value Golf is listed with the code 3931.

2. The colors of the Japanese candlesticks are opposite

In a Japanese candlestick chart, like the ones given in Fig. 1, the green color candles represent growth, while the red ones represent decay. More details on Japanese candlesticks can be found in the following article: "Japanese candlesticks. A complete explanation for beginners."

You might think that in Fig. 1 there is no difference between the candlestick colors of the given charts, and you are right because those charts belong to investing.com, a western platform. However, if we check instead a Japanese platform, the Value Golf chart would be given as follows:

Figs. 1 (left) and 2 represent the same variation over time for Value Golf, however, on the Japanese platform the growth is colored red and the decay is colored green. Why? It's just a convention that has its origin in China. In simple terms, in the oriental culture, red is a color that reflects prosperity and therefore it should be used to represent growth.

3. Japanese platforms only accept foreign investors if they live in Japan and understand Japanese. In the US, these conditions are not necessary

It makes sense for a local business to have this type of restrictions. However, in Japan things become more complicated with such restrictions because the registration process is solely given in Japanese. Luckily nowadays, thanks to the digital age, it is possible to cross the language barrier, for example, in my case, without knowing how to read the kanji, thanks to the help of Japanese friends I was able to register through the internet; however, I was required to prove that I had a fixed address in Japan. In the US it is very different, and the reason is that US financial institutions have a multinational status. Therefore, you neither need to live in the US nor know English to invest in the US stock market. If you don't know how to do it, I suggest you to read the article: "Steps to start investing in the US stock market." The missing question would probably be: "Is it possible to invest in Japan from outside?" The answer is yes, luckily, thanks to the digital age, nowadays we have plenty of multinational financial institutions that have access to Japan. among them one that I recommend is Interactive Brokers. More details about it will be discussed in a future article. However, you must know that a local company will always be much better than a multinational one because it provides greater benefits, starting with the fact that a currency exchange fee is no longer needed.

4. The Japanese stock market is opened less hours than the US stock market

It is well known that Japanese people are hard working people, to the point that they work much more than everyone else, but curiously, the Japanese stock market is only opened for 5 hours. The market opens at 9 AM (local time) and closes at 11:30 AM, then there is a one hour break so everyone can eat. After that, the market reopens at 12:30 PM and closes at 3 PM. Something very different happens in the US. On Uncle Sam's land there is no lunch break. The market opens at 9:30 AM and closes at 4 PM giving a total of 6.5 hours.

5. In Japan the minimum purchase is 100 shares

In the US you can buy 1 share of a company. In contrast, in Japan the minimum amount of shares that you can buy is 100. What does it mean? That if the share of a company has a value equivalent to 500 USD in the Japanese stock market, then in order to buy it, you must invest at least 100 x 500 = 50,000 USD. Let's see this with the examples given below:

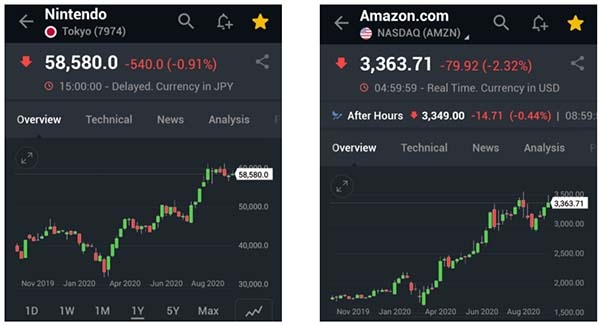

In 2020, as shown in Fig. 3, Amazon and Nintendo shares were valued at +3,000 USD and +50,000 JPY, respectively. Considering that on average 1 USD = 100 JPY, then Nintendo, which is listed on the Tokyo Stock Exchange, had a share valued at approximately 500 USD.

In order to buy Amazon at that time, you had to pay 3,000 USD, and with this you could only buy 1 share. It is quite expensive, right? Not everyone has that amount of money and therefore not many will be able to have Amazon shares. Interestingly, one would think that the Tokyo Stock Exchange is much more fair with its share prices because a well known company such as Nintendo barely costs 500 USD. Unfortunately, despite this, it will be even more difficult to buy Nintendo shares because the minimum amount in Japan is 100 shares and it increases in steps of 100, that is, to buy Nintendo shares, in your first investment you need 50,000 USD, and if you want to buy it again, you need another 50,000 USD, giving a total of 100,000 USD only in 2 investments. Do you think this is unfair? In a certain way it is, but on the other hand it gives quality to the investments in Japan because if they are very expensive, investors will think twice before buying these shares, as a consequence, they will be more aware of the future of the company. To better understand this, you can think of someone going to the shop to buy a shirt. If this person chooses an expensive brand, he/she will carefully think about it, and once he/she buys it, he/she will take care of it for a long period of time because it cost a lot. In contrast, if this person buys a cheap shirt, it is likely that he/she won't care if it tears apart, so it can easily lose its value

6. Japan does not allow gigantic fluctuations. USA does

The stock market, like anything in this world, has a set of rules. One of them establishes that the fluctuation of the share price in a given day must be framed in a given range. However, in practice, sometimes this is not followed. Of course, the Japanese stock market is more likely to follow the rules and thus avoid huge fluctuations. What does it mean? That on a given day, in Japan it is impossible to see an explosive growth of more than 100% in the share price of a company, because in case many decide to buy (or sell, in the opposite case), the stock market will be paused so that buyers and sellers relax and think even more when making such an investment. Sometimes the stock market is paused for several minutes, other times if this is not enough, the stock market is paused until the next day. In this sense, the so-called "day-trading," which consists of buying and selling shares on the same day to obtain immediate gains is not recommended in Japan because they would try always to prevent gigantic fluctuations. In the US, on the other hand, it is feasible to see in a single day a growth above 100%. As an example, let's consider the following figure:

As shown in Fig. 4, on a specific date, for example on October 15th, 2020, in Japan, the company with the largest fluctuation had a growth of approximately 30%, while in the US, on October 14th, 2020, the largest fluctuation exceeded 250%. In this sense, as I already said, "day-trading" would be relevant in the West and irrelevant in the East.

Views: 1

Notifications

Receive the new articles in your email