Mathematical History: 2009 - 2013

The First Bubble

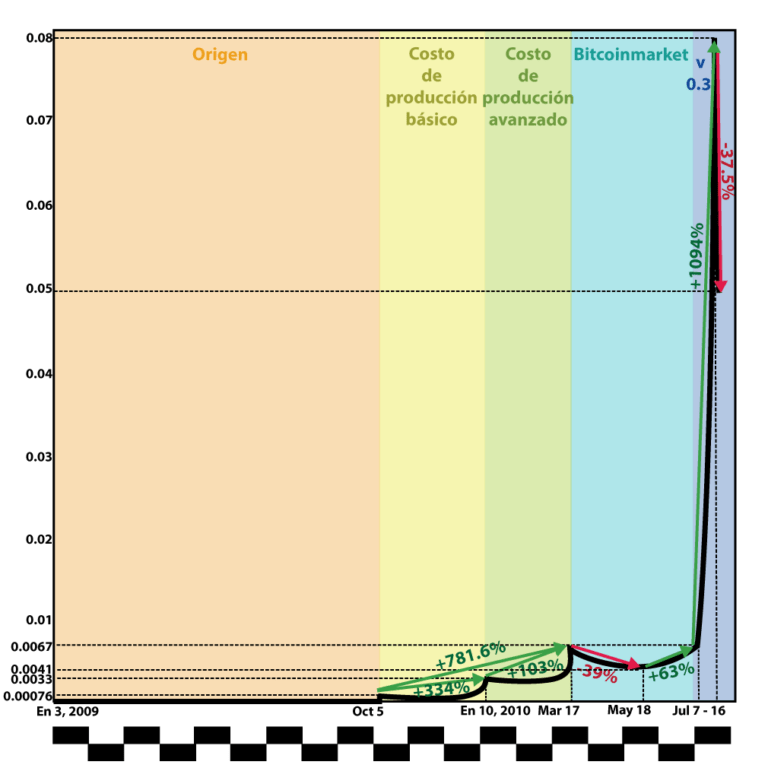

The origin - On January 3, 2009 it all started. Satoshi Nakamoto mined 50 bitcoins (BTC). What does this mean? If you want to understand it in more detail, I invite you to read: "The origin of bitcoins. Complete explanation for beginners". In simple words, Satoshi Nakamoto created 50 bitcoins and days later shared the code with the world so that others could do it too. On January 12 of the same year Hal Finney downloaded the program on his computer and immediately after, Satoshi Nakamoto transferred him 10 bitcoins. His intention was to prove that the program worked well, so he didn't mind giving Hal Finney 10 bitcoins. This became the first bitcoin transfer in history. And how much was 1 BTC worth back then? Well, it wasn't worth a penny, or rather, it wasn't worth anything at all. The transfer made by Satoshi Nakamoto was a simple game of algorithms in the intricate world of the internet. To understand it, you could imagine that Satoshi Nakamoto created a system like Gmail and to test its operation he sent a message to Hal Finney, which said that he gave him 10 bitcoins. Over the weeks, more joined the game. Who is it? Mostly geeks who love cryptography and programming, because they were the first to realize the potential that this digital currency could have. It should be noted that most of these men did not know each other, they had a strictly digital relationship, where the internet was the only means of contact. Therefore, you traveling back in time to that time, you could have collected the bitcoins in complete anonymity.

The Cost of Production - On October 05, 2009, a value was given to bitcoins. This is logical if you consider that you are part of a market that appears from nowhere. For example, imagine that you discover a precious stone in the mountains, some will pay attention to your discovery but others will not, therefore, in the beginning your stone will have no value. However, if the number of people paying attention to your find increases, it won't be long before someone comes up with a monetary value for it. In the case of bitcoins, it occurred to one of them to create an internet platform where they could exchange bitcoins for dollars. It was then that New Liberty Standard, was born, a web service that made use of PayPal. And how was the price defined? For this, it was considered how much electricity was spent on "mining" the bitcoins, since it required a computational effort. According to this, the website started on October 5 with a value of 1 BTC = 0.00076 USD. A week later, on October 12, the first transaction was made, the Finn Martti Malmi sold 5050 BTC at a premium value of 5.02 USD, that is, 1 BTC = 0.00099 USD. And who bought it? It was New Liberty Standard who did it because they needed funds to grow the business. On December 31, 2009, 1 BTC was worth 0.00069 USD [1 ]. The price was devalued by -9.2% compared to October 5, why? Simply because New Liberty Standard adjusted the price according to the production cost of bitcoins. However, in 2010, New Liberty Standard would redefine this value. On January 16, the cost of production ceased to be calculated considering only the cost of electricity and began to also include the cost of internet, among other factors. In this way, bitcoins abruptly became worth around 0.0033 USD, thus suffering a growth of +334% from its initial value, and its value gradually grew as users increased. Why? Because the energy consumption generated by the bitcoin algorithm is directly proportional to the number of users that are mining, that is, the more users, the higher the production cost. From here you can think that in the long term if bitcoins become popular then they cannot be devalued; however, we are forgetting the fundamental extrinsic factor: supply and demand, which will come to play an important role in the coming months.

Bitcoinmarket.com - Back then, the only way to get bitcoins was to mine them on a computer and if someone offered to sell theirs, very few paid attention because they knew that the most practical way to obtain them was by configuring a program on the computer. Remember that at that time only geeks who loved programming were aware of it, therefore, very few envisioned the idea of buying bitcoins using dollars. Also, who would pay for digital currencies that had no use? In economic terms, we could say that there was a strong supply of bitcoins, that is, many were willing to sell them, but there was almost no demand for them, that is, very few were willing to buy them. Under these conditions, a market could not consolidate, but it was a matter of time before new users would come to the market and alter the price of bitcoins. It was on January 15, 2010 that the user dwdollar published a post on bitcointalk.org and announced that he was working on building an exchange platform [2]. Unlike New Liberty Standard, this would be an exchange platform governed by the laws of supply and demand, that is, users would define the price of bitcoins according to their preference and not according to the cost of production. In this way, on March 17, 2010 bitcoinmarket.com was born and although it sounds curious, by that date the website only had 9 registered users. The first order was placed by dwdollar suggesting the last price recorded by New Liberty Standard: 1 BTC = 0.0067 USD. As you can see, from the day that New Liberty Standard redefined the cost of production, the price increased by +103% , and since its inception, achieved a growth of +781.6%, that is, if you invested 10 USD buying bitcoins on 05 October 2009, in March 2010 you would be selling them for 78.16 USD. However, over the weeks bitcoins would be devalued, but that was not important because users, beyond wanting the price to increase, were interested in finding some use for the currency. The first high-impact attempt came on March 30, 2010, when user SmokeTooMuch published a post on bitcointalk.org offering 10,000 BTC in exchange for 50 USD, i.e. say 1 BTC = 0.0050 USD [3]. It is considered to have a great impact due to the amount of bitcoins it offered, since until that date, purchases and sales had only been limited to low values and, above all, they were for experimentation. Also, SmokeTooMuch offered it on a forum and not on bitcoinmarket.com. Why? Because the intention, beyond making money, was to spread the concept and demonstrate through examples the usefulness that bitcoins could have. This goal was achieved with the second high-impact attempt, which came on May 18, 2010 when user Laszlo posted a post on bitcointalk.org reporting that he was offering 10,000 BTC in exchange for 2 family pizzas [4]. Immediately, Jercos, who had read Laszlo's request in an IRC chat, bought him two Papa Johns pizzas. It is worth mentioning that for that date on bitcoinmarket.com, 1 BTC was worth 0.0041 USD, that is, Laszlo's offer was very good because 2 family pizzas cost much less than 41 USD. This event marked a before and after in the universe of bitcoins, because now there was already a tangible example of the usefulness that the cryptocurrency could have. A month later the price became worth: 1 BTC = 0.0050 USD. Here you may be wondering if bitcoinmarket.com was the only page where one could buy bitcoins. The answer is no, it was just the most popular, by July 1, 2010 there were already several ways to get them, for example, we had bitcoinexchange.com, www.bitcoinfx.cz.cc, freebitcoins.appspot.com, buybitcoins. com, newlibertystandard.wetpaint.com, and of course, the forums and IRC chats.

The consolidation of supply and demand - On July 06, 2010, Satoshi Nakamoto officially launched the third version of the bitcoin program [5], named version 0.3; this allowed the price of bitcoins to exceed the value of 0.0067 USD on July 07 and the value of 0.0080 USD on July 12. With this, supply and demand would be consolidated as the determining factor of the price, that is, the cost of production would take a backseat. Why? Because version 0.3 had a worldwide impact. Articles began to be written about it, reaching various regions of the world [6 ], this meant that not only geeks who love programming began to be aware of it, but also outsiders willing to invest their dollars in bitcoins. On July 13, 1 BTC became worth $0.014, on July 14 it reached $0.022, on July 15 it reached $0.045, and on July 16 it peaked at $0.08 [7]. Since July 07, it had a growth of +1094%; however, on July 17 it was devalued to 0.05 USD, suffering a drop of -37.5%. On July 18, a new era would arise with the birth of the exchange platform MtGox... Below I summarize the given prices separated into 5 stages. In orange we represent the stage when bitcoins were worth absolutely nothing. In yellow we have the period in which New Liberty Standard defined a price based on the cost of production, given exclusively by the cost of electricity. In green, we have the stage of advanced cost of production, where New Liberty Standard added the cost of internet and other factors. At Celeste, we appreciate the era of bitcoinmarket.com, to whom we can attribute the birth and consolidation of supply and demand. Finally, in purple we have the small period that derives from the third update of the bitcoin program, which allowed articles to be written on the web for the first time, causing a wave of new users registered in bitcoinmarket.comand the emergence of the first financial bubble.

The Second Bubble

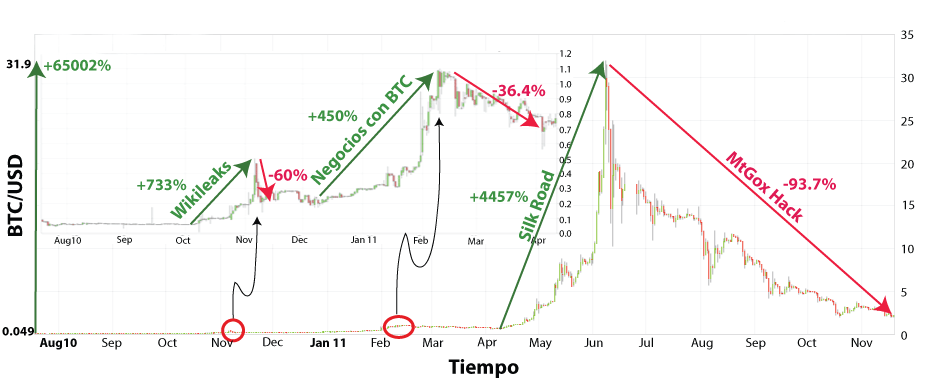

The Mtgox boom - Mtgox.com presented many improvements compared to bitcoinmarket.com, which is why over the months it became the preferred platform. If we analyze this in detail we can glimpse the consequences of generating a market from nothing. First it was New Liberty Standard who imposed the static idea of assigning a value to bitcoins, then they were widely surpassed by bitcoinmarket.com, who imposed the dynamic idea of governing the price based on supply and demand. When this reached solidity, the innovation came from Jed McCaleb, who defined a much more elaborate exchange platform: Mtgox.com, which ended up surpassing bitcoinmarket.com by far. >and over the months managed to take over the global market. The initial value with which Mtgox started on July 18, 2010 was 1 BTC = 0.049 USD [8]. In the days that followed, it was worth 0.093 USD, but over the months it fell to a stable value of 0.06 USD. It was not until October 09 that the price reached the value of 0.10 USD [9 ], thus reaching a new high in its history. This growth could be associated with version 0.3.13 of bitcoins that was made public on October 1 and generated new articles on the web [10]. You must remember that at that time bitcoins were not yet popular, and therefore each article generated attracted more users. Precisely, on October 9, a volume record was reached, 200 thousand bitcoins were bought and sold, adding a total flow of approximately 17 thousand dollars. It was not until November 06, 2010 that 1 BTC became worth 0.5 USD, a growth of +733% from its stable point in 0.06 USD, this brought the market capitalization of bitcoins to 1 million dollars, that is, adding all the bitcoins in circulation (all mined bitcoins) and multiplying them by the price of 0.5 USD we just reached 1 million, realize that for someone could have said that he was already a millionaire at this point in history, he should have absolutely all the bitcoins in circulation... But why did it grow so much in November? This event could have had a key point and it is the fact that at the end of 2010 the Wikileaks scandal exploded, which resulted in companies such as Paypal, Visa and Mastercard blocking their services from Julian Assange's accounts. Due to this, there was a lot of publicity for bitcoins because it was the name that sounded like an option for Assange to continue with his organization [11]. As of November 6, 2010, however, the price of bitcoins would begin to fall abruptly as a result of a correction, a pattern that would begin to repeat itself since July 2010 (see Fig. 1) and would be associated mainly with the psychological factor that presents a market. 1 BTC was worth 0.14 USD on November 10, culminating in an average value of 0.2 USD in December, thus representing an average drop of -60%. In 2011 things would be different because bitcoins would become more popular. It was in the months of January and February that it became very common to see people on forums advertising their businesses based on an economy governed by bitcoins, from the sale of electronic items, the tarot service, online games, and even prostitution services [12]. Any business became possible, which contributed to new sectors beginning to buy bitcoins; as a consequence, on January 31 it recovered the value of 0.5 USD and on February 09 it reached parity with the dollar (1 BTC = 1 USD) [13], thus achieving a growth of +450% from its stable point at 0.2 USD. However, it would later suffer a slight correction, declining -36.4% to the value of 0.7 USD to then embark in the month of April in which It is considered the second financial bubble of bitcoins.

Silk Road - A financial bubble is simply defined as when the price rises sharply above +1000%, at least that is the definition we will use in this article. The first time it occurred was in July 2010 (see Fig. 1), the second began in April 2011 and ended on June 8, reaching the maximum peak of 31.9 USD, which represented a growth of the +4457% from its support value of 0.7 USD (see Fig. 2) and generated a market capitalization of 203 million dollars. What was this growth due to? As we mentioned in the previous paragraph, it was at the beginning of 2011 that there was a strong wave of entrepreneurship, many businesses began to emerge, and although they perished over time, there was one that had worldwide repercussion: Silk Road. Unlike other businesses, Silk Road made its launch on the Deep Web official, in order to guarantee the complete anonymity of its users. It became an e-commerce site where one could buy and sell products using bitcoins without any type of restriction, this made it popular in the buying and selling of drugs, and although Silk Road granted a a bad image for bitcoins, after all it was publicity and many more followers emerged. What happened after? The price of bitcoins plummeted to 2.0 USD on November 18, 2011. It suffered a drop of -93.7% in 5 months... Why? Various factors. First of all, it is common that when a price rises sharply it suffers a hard fall because many users will seek immediate profits. For example, in the 4 days after June 08, 2011, bitcoins fell to the value of 10 USD. This would have been the lowest point if it weren't for the fact that in the following days the Mtgox system was hacked. This factor was decisive and brought, as a domino effect, additional computer thefts in various exchange platforms such as mybitcoin.com and bitomat.com. Many bitcoins were stolen and credibility in the currency was lost. But if you pay attention to these events, the problems were unique to the exchanges, i.e. the bitcoin blockchain was still strong. For this reason, the price would grow again, reaching a new historical peak in the following months. Here is a graph that summarizes the Mtgox era from its beginnings to its fall to 2.0 USD on November 18, 2011:

The Third Bubble

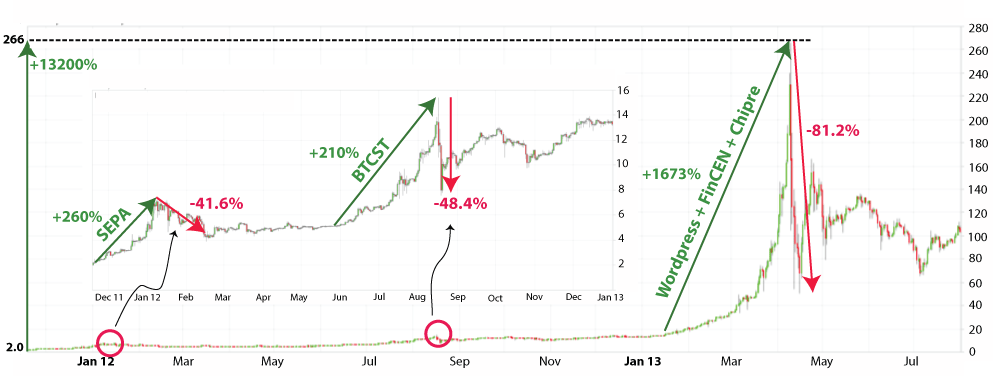

Bitcoin Savings & Trust - After the strong fall suffered at the end of 2011, bitcoin would recover again, growing from its lowest point at 2.0 USD to reach the value of 7.2 USD on January 08, 2012. This growth of the +260% was the product of various factors, including the psychological factor and technical analysis that determined that bitcoin had already bottomed out and therefore It was the right time to buy again. Another key event among many was the update of MtGox, which allowed, as of December 1, 2011, safer transfers and at a lower cost, e.g., SEPA transactions were accepted, that is, the free wire transfers for European residents became a reality [14]. This event came almost on a par with the first European bitcoin conference, which was held on November 25, 2011 in the city of Prague. After this, the price of bitcoins would begin to grow monotonously, reaching its peak, as we have said, on January 8, 2012. In the following days it would undergo a correction, falling to the value of 4.2 USD on February 18, representing thus a drop of -41.6%. It is important to mention that in 2012 computer thefts continued, that is, various platforms continued to be hacked and many bitcoins were stolen, this would have implied that the price should have depreciated; however, having bottomed out, bitsionaires had already become accustomed to living in a hostile environment, which is why in the following months bitcoins would fluctuate around 5.0 USD. It is in the month of June 2012 that the second wave would come, and it would not stop until August 17, the date on which bitcoins would reach the value of 15.5 USD, thus suffering a growth of +210%. What caused this second wave? We can cite three important factors. Firstly, computer thefts pushed platforms to develop more advanced security systems, in this way, the weakest ones perished and new, much stronger ones emerged, e.g., Coinbase was born in June and Bitcoinica died in July [15]. With the fall of the weak, investors were safer when buying bitcoins, therefore, the volume increased. A second point of considerable influence was the birth of Bitcoin Savings & Trust (BTCST) on Nov 03, 2011 [16]. Although it emerged at the end of the previous year and before the first wave, it was in mid-2012 that it had worldwide repercussions. This service created by Trendon Shavers offered interest of 7% weekly, which prompted many to buy bitcoins to invest in BTCST. But how was Shavers able to offer 7% profit to each of his users? For this he used a ponzi scheme where he paid old users with the bitcoins given by new users. In the long run, this was not sustainable and it collapsed precisely on August 17, 2012, the date on which BTCST began selling the bitcoins it had in its possession. It should be noted that by that date, BTCST had 7% of the total bitcoins in circulation, therefore its sales affected the market in a short time. On August 19, bitcoins became worth 8 USD, thus suffering a drop of -48.4% in just 3 days. Shavers was eventually prosecuted and sentenced to jail [17], but it's thanks to this scheme that the price of bitcoins touched the top of 15.5 USD. Finally, the third factor that influenced the growth of bitcoins was the arrival of the first large investors. For example, it is at this stage (June to August) that the Winklevoss brothers bought bitcoins [18], who are considered today as "bitcoin-millionaires". An important detail to note is that on August 17, 2012, 2.9 million dollars in bitcoins circulated, a value that had not been reached since June 8, 2011, the date on which bitcoins reached the top of 31.9 USD. This record would be broken in the coming months with the financial crisis in Cyprus that would bring with it the third financial bubble of bitcoins.

The crisis in Cyprus - At the end of 2012, bitcoins would oscillate between 10 and 12 USD without presenting great changes; however, little by little the way would be paved for a third wave. The turning point was granted by Wordpress on November 15 [19] , since it became as of that date the first consolidated company to accept bitcoins. Until this date, only businesses based on digital currency had emerged, of which many went bankrupt, but it is after this date that the venture went into the background and took on more force, as a domino effect, that various already consolidated institutions began to accept bitcoin. The Wordpress event occurred just before the "halving date" given on November 28th. The "halving date" is the date by which miner rewards are halved, i.e. fewer bitcoins are released into the system causing temporary deflation. In economic terms, deflation is synonymous with an increase in the price of the asset; therefore, one might think that bitcoins would necessarily increase in value, it was certainly the case, but the increase would come not because of this but rather because of the events that would come. On January 11, 2013, bitcoins would be part of the CES (Consumer Electronic Show, in English), which is a world-renowned event and therefore bitcoins would get more publicity [20]. Who invested money in this was the Bitpay company, which was founded in May 2011, and is one of the few companies that emerged with bitcoins and is still in force to date. Their mission is to allow the purchase/sale of goods and services using bitcoins, that is, they behave as intermediaries, providing security and agility in the process. Bitpay made a great decision to be part of CES because days later the price of bitcoins crossed the 15 USD barrier and its platform exceeded 10 thousand transactions [21]. Interestingly, after this, bitcoins would not stop growing until reaching the top of 266 USD on April 10, thus becoming the third financial bubble with a growth of +1673 %. For this, as we said, several events were raised. On February 09, 2013, as a consequence of Wordpress, Kim Dotcom's Mega company also started accepting bitcoins [22], which led to the price hitting an all-time high of $31.9 on Feb 28 [23], and at the same time broke the volume record, reaching transactions of more than 4 million dollars on that day. In March, another event of global repercussion took place, which would come as a consequence of the BTCST scandal. Until that date, bitcoins still did not have a legal meaning. For example, in the case of Silk Road, its founder was prosecuted for the sale of narcotics and not for the use of bitcoins. In BTCST instead, the illegal act compromised only bitcoins. Precisely, in subsequent trials, Trendon Shavers defended himself by arguing that there could be no illegal act because BTCST only exchanged bitcoins for more bitcoins. Being a new case, FinCEN (Financial Crimes Enforcement Network) had to adopt a position which was defined on March 18, 2013 [24]. In it, this federal entity defined that any act that compromised the USD/BTC exchange platforms was subject to the jurisdiction of the United States and therefore to prosecution in case of improper acts. Because of this, Trendon Shavers' rationale would not hold because their clients did not mine bitcoins but rather acquired them on exchanges. This result, although it did not provide facilities for the exchange, did record that a government institution was accepting the existence of bitcoins and their prompt regularization. Therefore, the price exploded in the following days touching the top of 75 USD. This would have stayed there if it were not for the fact that on March 25 the European Central Bank announced a financial support of 10 billion dollars to the banks of Cyprus because they were indebted with sums that the government could not cover [25]. But why does this benefit bitcoins? Because the loan would only be given if Cyprus as a nation contributed 7 billion dollars. And precisely to obtain that amount, the banks saw the need to retain their clients' money and charge them taxes, that is, if you had money in the Cyprus bank, then you would lose a percentage of your capital. This prompted many to withdraw their money early and others to speculate that the same could happen to all of Europe. So if the banks were no longer safe, where could they keep their money? Bitcoins rang loud and so the price shot up and peaked at $266 in April, only to drop to $50 once the panic passed, thus suffering a drop in -81.2%. Here is a graph that summarizes the era of the third financial bubble:

Denouement - In this article we have discussed the first three financial bubbles, if you want to understand the reason for the following bubbles, I invite you to read the second part of the article, not without first mentioning a detail given in the images presented here:

In Fig. 1, which goes from its origins to the high peak of the first financial bubble, we can say that bitcoin grew +infinite since its initial value was zero. In Fig. 2, which goes from the lowest point after the first bubble to the high peak of the second, we see that bitcoin suffers a growth of +65002%. Finally, in Fig. 3, going from the low point after the second bubble to the high peak of the third, bitcoin grows by +13200% . I want you to record these numbers because they will help us forecast the future of bitcoin...

Views: 1

Notifications

Receive the new articles in your email