We explain how the capital increase works considering the rights issue and show with mathematics the advantages and disadvantages of being part of it.

We explain how the capital increase works considering the rights issue and show with mathematics the advantages and disadvantages of being part of it.

There are financial terms that are difficult to understand from textbooks but they make sense once they become part of a real-life experience. The capital increase of a public company is one of them. In this article I’m going to consider Juventus as an example, in this way, by analyzing real data, we are going to understand what this financial term means; however, you must bear in mind that there are different ways to increase the capital of a company and the case described here is only one of them, but I consider it the most complete and therefore the most important to study.

A summary of this article with some extra info appears in the following video:

In an extraordinary meeting held on Oct. 24th, 2019, Juventus shareholders voted for a capital increase of the company of approximately 300 million euros, which had to be completed no later than Sep. 30th, 2020. Details of this increase were announced in a subsequent extraordinary meeting held on Nov. 26th, 2019, where it was agreed to create 322,485,328 new shares at a price of 0.93 EUR each, thus giving a total income of 299,911,355.04 EUR. In this agreement, the company Exor NV, which holds majority control of Juventus, promised to buy 63.8% of the new shares. Additionally, other companies such as BNP Paribas, Goldman Sachs International, Medibanca, and UniCredit CIB agreed to buy the remaining shares in a negative scenario, that is if the total number of new shares could not be sold.

The following dates were defined:

As you can see in Table I, the capital increase revolves around the rights, but what are the rights? They are preferential subscriptions to buy new shares. Let’s discuss, step by step, what happened with Juventus to better understand all this…

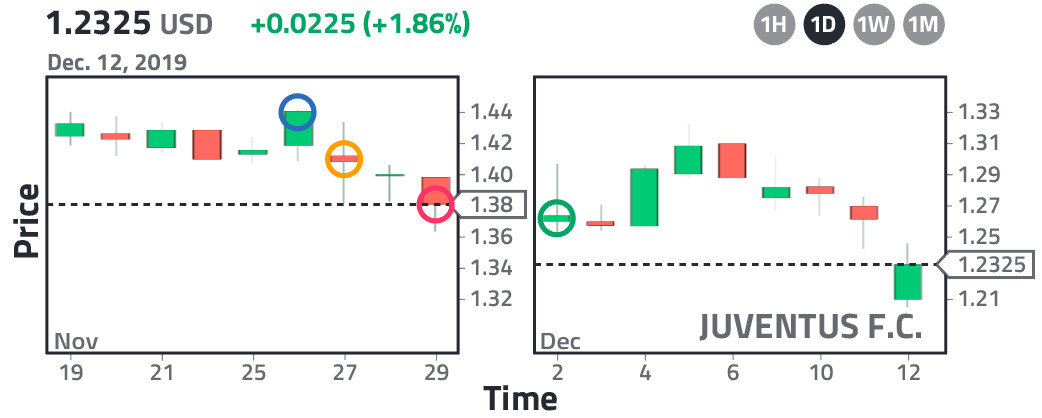

On Nov. 26th, 2019, I had 2,380 Juventus shares in my possession, that day the shares closed at a price of 1.44 EUR, as we can see in Fig. 1 (blue circle). In the evening, the extraordinary meeting was held and it was reported that the capital increase would begin on Dec. 2nd. As you can see in Fig. 1 (orange circle), this caused a drop in the price the next day, reaching a closing value of 1.41 EUR.

The question is why did it fall? It fell because Juventus shareholders were aware that a capital increase is related to a devaluation of the stock price. Moreover, a company deciding to increase its capital, likely implies that the company needs additional funds to grow and cannot be sustained with the current funds. In the case of Juventus, the annual loss for the 2018-2019 season was 39.9 million euros, while for the 2017-2018 season, Juventus only had a loss of 19.2 million euros. This makes sense considering the heavy investment they made to get Cristiano Ronaldo. The next question is: Why the capital increase is related to a devaluation of the stock price? This devaluation takes place on Dec. 2nd, the date of the rights issue. To understand why we have to consider the closing price one day before Dec. 2nd (Monday), that is Nov. 29th, 2019 (Friday). In Fig. 1 (red circle), we see that for this date the share price closed at the value of 1.38 EUR. Now let’s do some calculations:

As you can see in Table II, by adding new shares, the new unit price has to be 1.2709 EUR. That's why on Nov. 29th, the stock price that closed at 1.38 EUR, was immediately devalued in 1.38 – 1.2709 = 0.1091 EUR. This is appreciated in Fig. 1 when comparing the left chart (November) with the right one (December). This is the reason why some Juventus shareholders when they found out about this on Nov. 26th, decided to sell their shares, even at a loss because they knew that the price had to be devalued and they could buy again at a lower price. However, why did others, including me, choose not to sell? Because the difference, 0.1091 EUR, was given back to the shareholders in rights. In my case, this is shown in the following table:

On Nov. 29th I only had 2,380 Juventus shares; however, on Dec. 2nd, the company granted me 2,380 rights (see Table III). Initially, the values were 1.2709 EUR and 0.1091 EUR for shares and rights, respectively. In Table III you may notice that these values are different. This is because the table corresponds to the data of Dec. 12th and by then the values were already fluctuating because people began to buy and sell according to their personal projections. Consequently, as you can see, shareholders did not lose 0.1091 EUR per share from Nov. 29th to Dec. 2nd, rather, it was given back in rights to buy new shares at a price of 0.93 EUR. This will be much more clear considering the following figure:

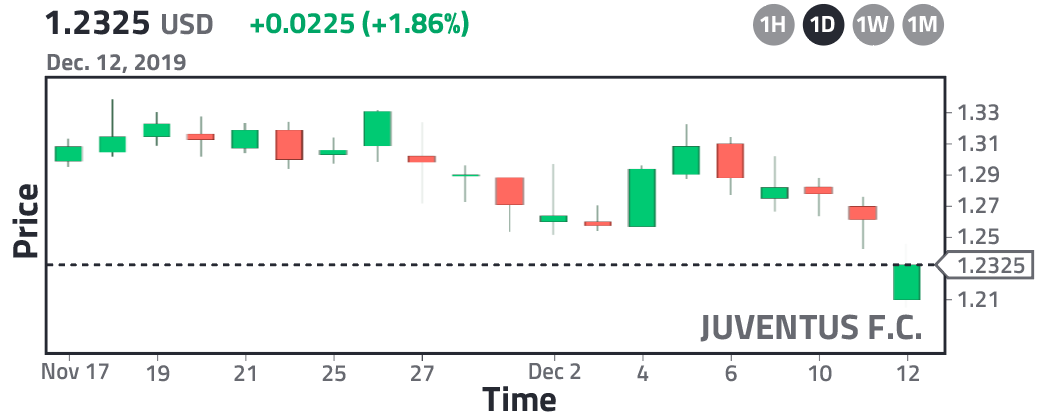

Fig. 2. is exactly the same as Fig. 1, except that the prices have now been updated for dates prior to Dec. 2nd with a devaluation of 0.1091 EUR. For example, in Fig. 1 we said that on Nov. 29th the stock price closed at 1.38 EUR; however, in Fig. 2 we see that it closed at 1.2709 EUR. What is interesting is that all the prices since the first day that Juventus was listed on the Milan Stock Exchange have been devalued. Therefore, future investors will not know that there was a time (before Dec. 2nd, 2019) when the price of Juventus was worth 0.1091 EUR more. For example, if you ask an old shareholder what has been the highest price that Juventus shares have had throughout its history? This shareholder will answer: 1.7791 EUR and it happened on Sep. 20th, 2018; however, a new shareholder would reply: 1.67 EUR and it happened on Sep. 20th, 2018. What is the correct answer? Both are correct, however, the old shareholder should add: “…but on December 2nd, 2019, there was a capital increase and all values were devalued by 0.1091 EUR.”

Now let’s move on to discuss how you buy the new shares. On Nov. 26th, the company released details regarding this, saying that for every 25 rights purchased, one could access to buy 8 shares at the price of 0.93 EUR. The old shareholder, in contrast to the new investor, has a particular advantage, and it is the fact that he or she no longer has to buy the rights because these are automatically granted in the same proportion of the old shares (see Table III). In my case, for example, because I kept 2,380 shares, I received 2,380 rights free of charge. What I could do would be to sell my rights on the market or keep them to exchange them for new shares. Below I describe possible scenarios for old and new investors, click on the one that is of interest to you:

An important factor to note is that the price of the rights is very small, therefore, it has a high volatility, e.g., if the price fluctuates from 0.10 to 0.11, this means a change of 10%. In the case of Juventus, the price fluctuated from 0.075 EUR to 0.121 EUR, that is, it reached a variation of 61.3%. Due to this volatility, many seek to buy rights with the sole purpose of reselling them at a higher price in the days that follow.

Now let’s consider the case of a new investor who buys rights with the purpose of buying new shares. As an example, let’s take the case in which you buy rights at the value of 0.075 EUR, then if you invest 75 EUR, this gives you 1,000 rights that give you access to 1000/25 x 8 = 320 shares at the price of 0.93 EUR, that is, in addition to the 75 EUR invested in rights you have to pay 320 x 0.93 = 297.6 EUR to receive 320 new shares. In this case, the deadline is Dec. 18th, meaning that if you miss the deadline you lose your 75 EUR because the rights cease to exist on that date. In summary, you would have 320 shares and you would have invested 297.6 + 75 = 372.6 EUR, giving a unit price of 372.6 / 320 = 1.16 EUR for each share. Note that the price is below the market price of 1.24 EUR, consequently, this simple purchase gives you an almost instantaneous profit of 1.24 – 1.16 = 0.08 EUR per share, that is, 320 x 0.08 = 25.6 EUR in total with an investment of 372.6 EUR. Of course, the outcome is uncertain, perhaps on Dec. 18th the price falls below 1.16 EUR and you start to have losses or perhaps it rises above 1.30 EUR and you end up earning much more. It all depends on how well the company performs from then on.

To conclude, I want to share with you that I was part of the capital increase because the plan presented by the Board of Directors was very interesting. 300 million euros is quite a lot, enough to bring in the following season another world-class player like Cristiano Ronaldo. Moreover, it was in the 2019-2020 season that the Juventus Hotel (Hotel J) was inaugurated and it promised to bring an extra income to the club. They also opened offices in Hong Kong, so Juventus, as a brand, started to have a presence on the Asian continent. And what to say about the football team that is always one of the favorites to win the next Champions League… The outcome of my Juventus investment appears in the following article: "Forecasts from March 2019 to January 2021."

Afternote: Juventus gave me losses over time due to the global crisis that was triggered by the coronavirus.

Views: 1 Sports

Notifications

Receive the new articles in your email