We explain how the world currencies fluctuate during a financial crisis. As an example we consider the event that arose in the year 2020: The coronavirus. The conclusions given here will allow us to face future crises and make profits exchanging currencies.

We explain how the world currencies fluctuate during a financial crisis. As an example we consider the event that arose in the year 2020: The coronavirus. The conclusions given here will allow us to face future crises and make profits exchanging currencies.

A summary of this article with some extra data appears in the following video:

By the end of 2019 and the beginning of 2020, the world market dramatically changed its course due to a tiny particle 100 nanometers long: COVID-19. In this article, we seek to understand what happened to the currencies during this period and based on this information we forecast their future. We focus on five currencies: The Peruvian sol (PEN), the US dollar (USD), the Chinese yuan (CNY), the euro (EUR), and the Japanese yen (JPY), being the first representative currency of an emerging country.

First, as an introduction, let's see how much money you would have made if you would have followed the advice given in the article: "How to make money exchanging currencies. The secret of forex," written in 2018. There we mentioned that the USD/PEN exchange rate had an upper bound of 3.38 and a lower bound of 3.24, that is, the dollar, with respect to the Peruvian sol, was meant to fluctuate between these values. We also mentioned that these bounds would be broken in the next global crisis. In Fig. 1 we show the USD/PEN exchange rate for the period 2019-2020, where the gray lines refer to the aforementioned upper and lower bounds. As you can see, our prediction was fulfilled, the upper bound was broken in March 2020 due to the global crisis triggered by COVID-19. Moreover, we also mentioned that in order to obtain profits it would be advisable to buy at 3.27 and sell at 3.35 (blue lines in Fig. 1). However, we added that if we wanted to take a low-risk approach, it would be better to buy instead at 3.29 and sell at 3.33 (purple lines in Fig. 1), which implies that for every 1,000 USD, we would be making a profit of 40 PEN.

In Fig. 1, the black arrows represent our transactions if we would have followed the low-risk advice, that is, buying on the tail of the arrow and selling on its head. Obviously, if we would have taken into account the news, we would have sold above 3.33; however, here to simplify the analysis, we disregard the news. The first two arrows go from March to August 2019, there you would have made a profit of 80 PEN. After August you would have noticed that the dollar was constantly reaching the upper bound, then you would have thought that in the future the lower bound should be above 3.29. That's why when the dollar fell sharply in December, you would have been convinced that it was the right time to buy, especially because of the shape that the Japanese candlestick took on those dates (see orange circle in Fig. 1). To understand how a Japanese candlestick can give us a hint of the direction of an asset, I recommend to read the article: "Japanese candlesticks. A complete explanation for beginners." There you will notice that a candlestick as it appears in the orange circle of Fig. 1, called Dragonfly Doji, is a strong indicator of a downward reversal, therefore, it tells you that it is the right time to buy. You would have bought dollars, for example, at 3.30 with the intention of selling them at 3.38. In this process you would have made a profit of 3.38 - 3.30 = 0.08 PEN for each dollar invested, that is, with 1000 USD, you would have made 80 PEN in profits. Adding the 3 gains (arrows in Fig. 1), in total you would have made 160 PEN, which is considerable for a forex market. In percentages, this profit represents 5% of your investment.

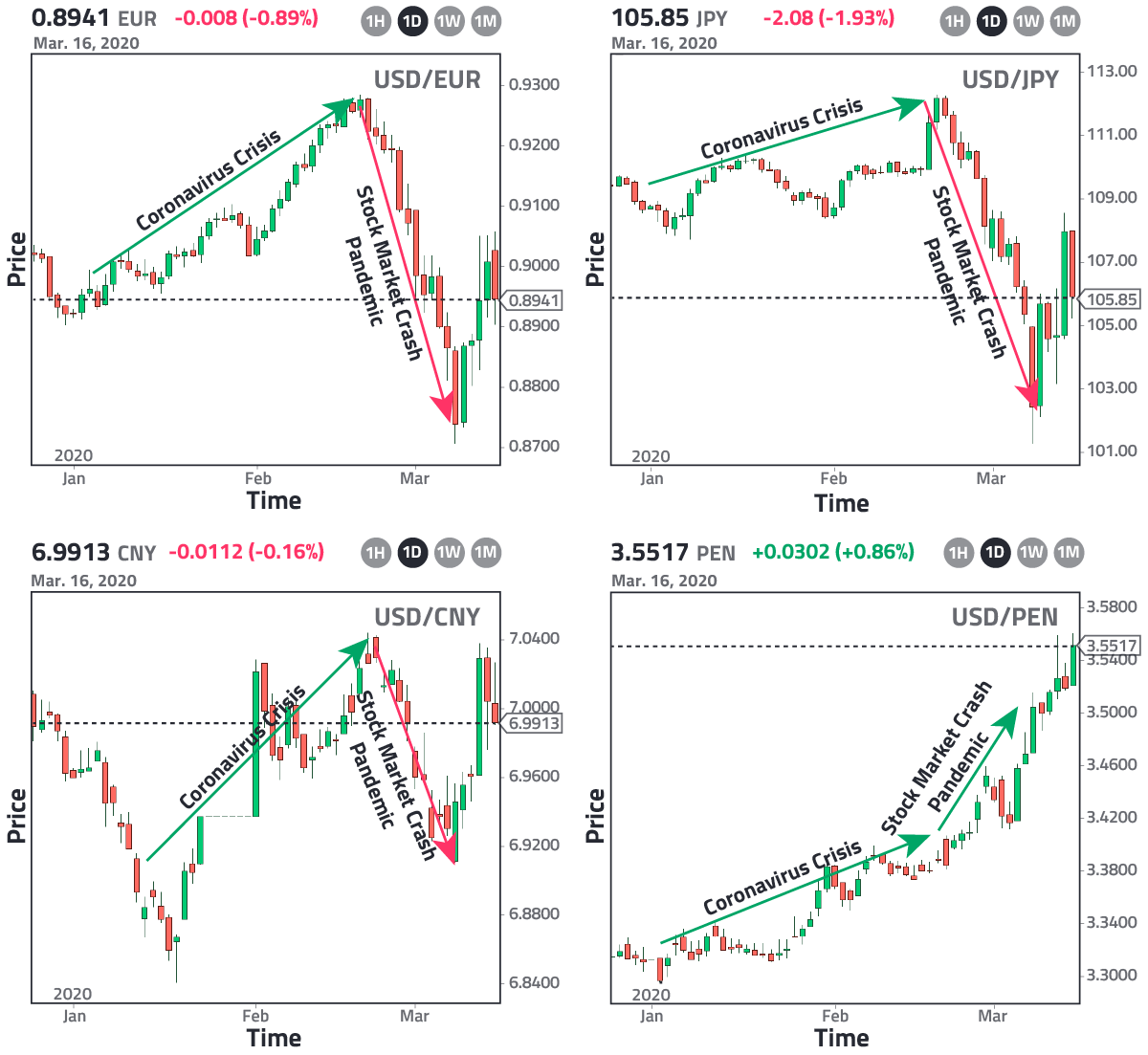

Now let's understand if it really would have made sense to sell your dollars at 3.38. For this, we have to ask ourselves if it was possible to predict the future of the dollar. The answer is yes. It turns out that COVID-19 appeared in China by the end of 2019, and it was officially considered a problem in Asia in January 2020; therefore, imagine that you are an investor who has money in this continent, what would you do if there are problems there? Well, you sell the local currency because it is not convenient for you to have money in a region that is having problems. In February, the virus reached the European continent, therefore, not only Asian investors but also European ones exit their positions in those continents and began to buy the most powerful currency in the world: The dollar. Especially since the epicenter of the virus was far from the American territory. That's why in January and February the dollar rose against all the currencies of the world, see Fig. 2.

In Fig. 2, the green arrow represents the first months of the viral crisis. If you would have been aware of the Chinese problem in December, you would not have sold your dollars because you would have thought that the Asian crisis would trigger a strong demand for them. Nonetheless, what happened at the end of February? On February 20th, 2020 to be exact, the World Health Organization (WHO) declared that COVID-19 was already a pandemic and with it, the dollar collapsed against the strongest currencies in the world (see Fig. 2). Why? Because the investor, who had chosen to buy and hold the dollars, changed his/her mind and sold them due to the fact that in a pandemic not only the Asian and European continents are in trouble but also the American territory. Where then does the investor deposit his or her money? In periods of global crisis the holy grail is gold, that is, investors sell their dollars to buy gold bars. Precisely, you can clearly see this in Fig. 3 where we show the price chart of gold and the S&P 500 index for the month of February. This index takes the average of the 500 largest companies listed on the United States Stock Market. As you can see, on February 20th, this index began to plummet, and on that same week, gold experienced massive growth.

It is important to know that on February 20th not only the United States Stock Market fell but in fact all the markets around the world. And here you may be wondering: "But if all the markets fell, why the dollar lost its value with respect to the other currencies?" The reason is that from a relative point of view, the dollar fell much more than the other currencies, and this is because the dollar is the most powerful currency in the world; therefore, a fall in the US Stock Market is felt much more than a fall in a smaller market. What is interesting, as seen in Fig. 2, is that the dollar did not depreciate against the Peruvian sol. Why? Because Peru is an emerging country and cannot compete with the United States in the same way that Japan, China, and Europe did. Fig. 2 is a clear example of how in a global crisis the most affected countries are the emerging ones, those that base their economy on the export of raw materials, because while the other currencies were able to recover with the fall of the dollar, the Peruvian sol suffered a second blow. To understand this in more detail, just imagine that Peru exports raw materials to the United States, which are used by its companies to build technology and resell them to the world. With the global crisis and the subsequent closure of businesses, the last thing these companies would think of would be to buy raw materials; therefore, Peru stops receiving an income from its exports, and investors no longer need the Peruvian sol, that is, a fall in the dollar and the US Stock Market greatly harms emerging countries such as Peru. In strong countries, on the other hand, this is not the case because they can deal with their own technologies to sustain their economies. Proof of what I just said is given in the following figure:

In Fig. 4 we have the price chart, within the last 5 years, of two companies listed on the Lima Stock Exchange. Each Japanese candle is equivalent to a month in duration. As you can see, the company focused on raw materials, i.e., Minas Buenaventura, collapsed in the first four months of 2020 (see blue box), suffering a loss of over 50%, while the company focused on taking care of your money, i.e., Banco de Credito del Peru, only suffered a loss of ~11% (see blue box). This shows that raw materials in emerging countries are drastically affected during a global crisis.

Finally, we will answer the following questions trying to forecast the future of the currencies. I suggest that you read the answers in order because they are connected to each other. You must bear in mind that this article is written on March 19th, 2020, and therefore the future begins on March 20th. You must also bear in mind that these answers correspond to my personal assessment and therefore only the future will judge how accurate my answers were.

At the time of writing, the USD/PEN exchange rate had reached a record of 3.55 PEN, a value that had not been touched since 2016. Therefore, mathematically speaking, it is not convenient to buy dollars because it is at a very high point, and although in the long term, it can grow even more, in the short term it has to fall because any growth that is abrupt must undergo a rebound called a correction. Therefore, it is convenient to sell dollars.

Afternote: The dollar fell to 3.35 PEN on April 08th and 23rd, 2020.

Due to COVID-19, most companies shut down their businesses because the governments imposed a quarantine. Shutting down a business implies that the production slows down and without production then there are no profits that will give rise to taxes that the government can use in public spending, and this spending will encourage citizens to buy goods and services... As you can see, it is a vicious circle that collapses if one of the elements begins to fail. But the real problem with COVID-19 is not the virus itself, but rather the gigantic debts that companies have, because if there were no debts, these companies would have their own piggy banks that they could break in a quarantine period and thus easily overcome the crisis. Unfortunately, this is not the case, companies, with the intention to grow, have borrowed large sums of money over time, so today they are in debt; therefore, if production slows down they can no longer pay the interest of their debts and must file for bankruptcy. Governments cannot allow this, because if a company goes bankrupt the unemployment rate increases and this would create even more panic in the society because people without jobs won't know what to do with their lives. To solve this problem there are 3 methods that governments would likely use: i) Reduce the interest on debts. ii) Print new banknotes. iii) Apply quantitative easing. The first allows companies to feel relief from debts and use this extra money to revive their production. The second has the same purpose, the government prints new money that will be lent at low interest to companies, and the third one follows a similar printing approach but now the government itself buys shares of financial companies. In this way, it attracts investors to buy shares in the stock market and the economy bounces back.

Afternote: All three methods were used to revive the economy.

These methods, in the long term, give rise to inflation, because what the governments do is inject new money into the market. However, in the short term, they will boost the companies because they will attract investors, that is, in the short term, the strongest currencies of the world will appreciate because there will be a great demand for them, while in the long term, they will depreciate because there will be a great supply of them. The scenario is different if we talk about the currencies of emerging countries because they strongly depend on the policies adopted by the first world countries. For example, the Peruvian sol will depreciate in the short term, but in the long term, it will appreciate. To understand this, let's consider again the case in which Peru exports raw materials to the United States. If the North American companies start to grow again then they will start to buy raw materials to revive their productions. This gives rise to a demand for the Peruvian sol. However, at this point, the demand for the dollar is much larger because investors are truly interested in injecting dollars into the companies. This is transitory, once the hype is over, inflation peaks and the dollar loses its value; however, because production becomes a necessity, the demand for the Peruvian sol and its raw materials continues to increase.

Afternote: The USDPEN exchange rate continued to appreciate throughout 2020 as COVID-19 began to mutate and vaccines took time to arrive.

Based on the technical analysis, the dollar should fall to 3.38 PEN because this was the upper bound in the previous cycle and when an upper bound is broken, it usually becomes a lower bound in the next cycle. This fall should happen in the short term and likely it will repeat itself in the long term. In the short term, it will be given by a mere correction. In the long term, it will happen because world production will increase and the crisis will be over; consequently, I consider that buying dollars at 3.35 PEN would be ideal. You may be asking: "But if the lower bound would be 3.38, how come I could buy at 3.35?" This is because in a correction the lower bound is usually broken for a short period of time. Moreover, it is always better to be on the safe side and choose a value that has always been touched. A second question that you may have could be: "Why don't I buy dollars at 3.55?" You could because there is a high probability that it will keep growing while the crisis is not solved, but as I mentioned in the article: "How to make money exchanging currencies. The secret of forex," the difference between the buying and selling prices of the exchange currency agencies vary over time, and in periods of high volatility this difference becomes larger, that is, you would be taking a high risk to obtain a slight profit. The most reasonable thing to do is to buy with the fall and then check the news to project what will come.

Afternote: The dollar fell to 3.35 PEN on April 08th and 23rd. Then it reached a record high because the vaccines took time to arrive.

All currencies will go through a period of inflation, then the one with the lowest inflation rate will become the strongest currency during the crisis. Here I won't discuss the yuan, because China, having the most powerful workforce in the world, could easily alter its currency value against all odds. I'm going to discuss the remaining currencies: the euro, the yen, and the dollar. I consider the following ranking: 1) yen, 2) dollar, and 3) euro, that is, according to me, the yen will become the strongest currency during the crisis; therefore, it would be convenient to buy yens since now. Keep in mind that, in the short term, the US policies will allow the dollar to appreciate, but in the long term, with global inflation, it has to depreciate. And why the yen? i) In periods of global crisis, the yen has always been one of the favorite currencies to use as a hedge, and this is because Japan is the top 1 foreign investor, that is, Japan leads the ranking of foreign investors in the world, which means, for example, that the Japanese people prefer to invest in the United States rather than in Japan; therefore, when a crisis begins and everyone wants to buy dollars, the Japanese already have dollars with them because they are constantly investing in the United States. As you can see in Fig. 1, against the Japanese yen, the dollar grew slightly in January and February, while against the other currencies, it grew drastically, this reflects what I just said. Moreover, when the crisis reached its second phase at the end of February, the dollar fell sharply against the yen, precisely for the same reason. When the pandemic is confirmed, the Japanese sell all their foreign assets and return to their local currency, that is, a strong demand for yen arises, and because everyone in the world knows this, not only the Japanese people start to buy yen but also foreign investors. In the near future, it is plausible that something similar will happen, that is, when the US Stock Market starts to grow, the dollar will grow against the Japanese yen, but once the inflation comes, the yen will recover its value and will become the strongest one. ii) In Japan a quarantine is not needed because they know how to take care of themselves. They wear face masks all the time, even when no one is sick. iii) The third point is related to the Japanese mentality. They could work 7 days a week with great conviction if it is needed to save the nation. iv) The fourth point is related to the health system. In Japan, health insurance only covers 70% of the cost, then every time a Japanese goes to the doctor, he or she must pay 30% of the cost. Now I could ask you the following question: "If you live in a country where health insurance is 100% covered, would you go to the doctor or not? Of course! But if the health insurance only covers 70% of the cost, you might think twice before going. This allows to lower public spending during a viral crisis, and as a result, the government may end up printing fewer banknotes. v) The fifth point is that COVID-19 began in Asia in December 2019; therefore, this region of the world is one step ahead in handling the crisis. And why do I put the euro in third place? Because on March 13th, 2020, the World Health Organization considered Europe to be the new epicenter of the virus. Over there, there was a general quarantine where bars and restaurants shut down their businesses, that is, higher debts and less taxes for the governments. Additionally, Europe presents the most beautiful health insurance system in the world because it is efficient and covers 100% of your treatment. Precisely because of this, hospitals and clinics were full leading to a higher spending of the government. Therefore, Europe will be forced to print more banknotes than Japan and the United States, becoming the weakest currency among the three.

Afternote: My forecast was not fulfilled. The euro became the strongest currency during the crisis. The reason is explained in the article: "Forecasts from March 2019 to January 2021."

The resolution of the crisis will be reflected in the stock market, which I believe will fall again in July 2020 because the financial results of July won't be satisfactory as a result of the quarantine. Then a second quantitative easing may be needed, repeating the inflationary cycle once more. The bottom will be reached once the vaccines are spread around the world or once the virus disappears on its own. In any case, the solution to this problem will have an impact on the US presidential elections. If it is solved before August, Donald Trump will win the elections, if not, Joe Biden will take the post.

Afternote: The forecast was not fulfilled. The crisis was not reflected in the stock market. While the gross domestic product in the world fell during the year 2020, the stock market reached a record high. This was due to a large printing of banknotes, a low-interest rate, and a high unemployment rate, which motivated investors to buy shares on the stock market rather than reviving the production.

The final message that I can leave you is: "Don't buy dollars when it is high, be patient because the day will come when they will fall and you will be ready for that."

Views: 1

Notifications

Receive the new articles in your email