I share with you 5 reasons why it is better to bet the Champions League matches on the stock market than on the bookmaker. For this, I consider Ajax and Juventus as real examples.

I share with you 5 reasons why it is better to bet the Champions League matches on the stock market than on the bookmaker. For this, I consider Ajax and Juventus as real examples.

A summary of this article with some extra info appears in the following video:

Mathematically, what is better, to make bets on the stock market or to do them on the bookmaker? In this article, I'm going to give you 5 reasons why it is better to put your money on the stock market than on the bookmaker. To do so, I will consider the Champions League 2018-2019.

First of all, you have to know that there are football teams that are listed on the stock market, that is, they are public companies and therefore you can become one of the owners. If you don't know how the stock market works, I invite you to read the article: "The stock market. A complete explanation for beginners."

The football teams that are listed on the stock market are Borussia Dortmund, Olympique de Lyon, Juventus, Ajax, Manchester United, Roma, and Lazio, among others. Each one is listed on the stock exchange of its respective country, for example, Juventus is listed on the Milan Stock Exchange and Ajax is listed on the Amsterdam Stock Exchange. There are exceptions such as Manchester United which is listed on the New York Stock Exchange.

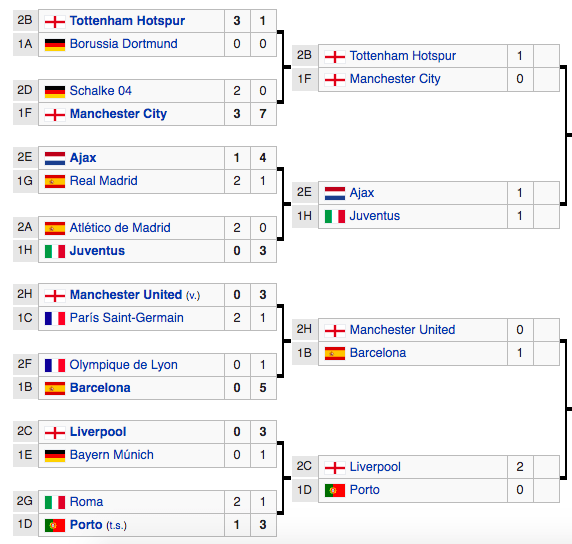

As seen in Fig. 1, in the Champions League 2018-2019, Juventus faced Ajax in the quarter-finals. In this article, we are going to place ourselves on April 16th, 2019, the date of the second leg between Juventus and Ajax, and we are going to make a bet. On the bookmaker, one not only bets on the winning team, but you can also bet on the number of goals or on which players score the goals. On the stock market, in contrast, you don't have many options, you only bet on the winning team, and what is worse, you only choose among a limited number of teams. For example, in the Champions League 2018-2019, the quarter-finals only had 3 three teams that were listed on the stock market: Juventus, Ajax, and Manchester United. Then, you could only bet on these 3 teams. One may think that because of these limitations, the stock market is less interesting than the bookmaker; however, this is not true, and the main reason is that putting your money on the stock market is not a bet, but instead an investment. Why? To understand it better, let's see the 5 advantages of putting your money on the stock market rather than on the bookmaker.

1. You can "bet" the amount of money that you want

Let's imagine that we are fans of Juventus. The quarter-final first leg was played in the Netherlands, where Juventus tied Ajax. The second leg is played in Italy. What do you think the outcome would be? The odds are high that Juventus will win. Then, what do we do? We bet on that! We can choose a bookmaker, either physically in your town or virtually through the Internet. All of them have a particular limitation: "There is a maximum bet that you can make." Why do you think bookmakers put a limit to the bet? Because it is safe for them. If there were no limit, someone could bet a billion dollars and win, if so, the bookmaker won't be able to pay this person back.

On the stock market it is different, you can "bet" the amount of money that you want, and there is no limit... well, the truth is that there is a limit, but that limit would make you the only owner of the company because it corresponds to buying all of its shares.

2. If you lose your bet, you don't necessarily lose your money

This is the most powerful advantage of the stock market because it tells you that you can make a profit even if you lose your bet. How? Let's see this with an example. In the round of 16 of the Champions League 2018-2019, Atletico de Madrid faced Juventus. The first leg was played in Madrid on February 20th, 2019 and the second leg was played in Turin on March 12th, 2019. Let's consider that these matches have not yet been played, so what do we do? We make a bet. Our first-leg bet is that Juventus wins in Madrid. We choose a 50 EUR bet on a bookmaker. As you may notice, after the match we would have lost 50 EUR because Juventus lost 2-0. What if instead of the bookmaker we would have chosen the stock market to place the bet?

To answer this, let's consider that on February 20th, 2019, you put 1,440 EUR on the Milan Stock Exchange. Then you would have bought 1,000 Juventus shares because the share price on that date was ~1.44 EUR, see Fig. 2. In this figure Japanese candlesticks are used. To understand them, I recommend you to read the article: "Japanese candlesticks. A complete explanation for beginners." What would have happened with your money after the match? The following day, due to the fact that Juventus lost, the share price plummeted to ~1.26 EUR. This means that on February 21st, 2019, your investment of 1,440 EUR was worth 1,260 EUR. You would have suffered a loss of 180 EUR overnight. However, as you can see in the chart, the day that Juventus thrashed Atletico de Madrid in the second leg, the share price jumped abruptly to ~1.56 EUR. That is, on March 13th, your initial bet of 1,440 EUR was worth 1,560 EUR. You would have made a profit of 120 EUR. You can see that even though your initial bet put you at a loss, over time you would have managed to win because this was a long-term bet, better called an investment, something that is not possible to make on the bookmaker.

Let's see it now in percentages. In the bookmaker, if you bet 50 EUR and lose, then you lose 100% of your money. On the stock market, in contrast, the percentage is smaller. Let's focus on Juventus, with the first bet you would have suffered a momentary loss of 180 EUR, equivalent to 12.5% of your investment. But if you would have waited a few more weeks, you would have ended up earning 120 EUR, which is equivalent to a growth of 8.3% of your investment.

3. If you win, you win much more

Let's travel back in time to April 16th, 2019... the match Juventus vs Ajax starts at 9:00 PM, so we can place a bet before that time. In Table I we show how a typical bookmaker payout looked like on that date:

It tells us: i) If you bet 10 EUR on Juventus and win, you receive 16.7 EUR, which is equivalent to a profit of 6.7 EUR. ii) If you bet on a tie, you would receive 39 EUR, equivalent to 29 EUR in gains. iii) If you bet on Ajax instead, you would receive 55 EUR, equivalent to 45 EUR in gains. In percentages, these values are equivalent to a profit of 67%, 290%, and 450% of your initial investment, respectively. Seems huge, right? Now let's see what are the values on the stock market:

In Figs. 3 and 4 we show how the share price of Ajax and Juventus changed one day after the match. Interestingly, a bet on Ajax would have netted you in profit, 10.2% of your initial investment, which is far from 450% offered by a bookmaker. However, if you would have bet on Juventus, on the stock market you would have lost -22.9% of your investment, while in the bookmaker the loss would have been 100%. So far you will agree with me that the stock market is great when you make a mistake because you lose a small percentage of your investment, but what happens when you win? Let's imagine that we bet 50 EUR on Ajax in a bookmaker. We would receive 50 * 5.50 = 275 EUR, which gives 275 - 50 = 225 EUR in net profit. Now let's consider that we invest 1,700 EUR in the stock market. As seen in Fig. 3, one day before the game the value of the share was ~17 EUR, and a day later the price increased to ~18.7 EUR. This means that our initial investment would now be worth 1,870 EUR, giving a profit of 170 EUR. It is true that 170 EUR is less than 225 EUR. But you are forgetting that in the stock market there are no limits on your investment, for example, if you would have invested 5,100 EUR, you would have made 510 EUR in profits. Consequently, you will always be able to win more when you put your money on the stock market.

You may not agree with this by telling me that you don't bet a lot of money on a bookmaker and still you can make a lot of profit. Yes, you are right, but then you are also risking the chance of losing everything.

4. You can continue to make profits even when there are no games

Bookmakers pay you as soon as the game ends, on the other hand, on the stock market your profits may continue to grow even after the game. An example is given in Fig. 2. As you can see, when Juventus beat Atletico de Madrid, its share price jumped from 1.26 to 1.56 EUR. This corresponds to an immediate gain after the match, but this was not the end because the share price continued to increase even days after the match, reaching 1.72 EUR one month later. This means that the stock market can continue to increase your profits despite the fact that the initial game has already finished, this phenomenon is known as momentum, that is, a company has momentum when the price of its share continues to grow over the days after a specific event.

5. An investment will always be better than a bet

This point was already mentioned in reason 2, where we showed that thinking in the long term is better because if you lose your initial bet, you can still recover your money because the share price may increase back over time. A long-term bet is actually an investment because you are not relying on one single game but instead on the team as a whole. For example, if we would have invested in Juventus just before the second leg against Ajax, then we would have lost money because the share price fell -22.9%. But this loss is called a "pseudo-loss" because you still have the same quantity of shares of the company. It is not until you sell your shares at a lower price that you start having real losses. Then, if the share price of Juventus was 1.70 EUR when you bought it, and it fell to 1.42 EUR after the match, eventually, there is no reason to be scared because in the future it may reach 1.80 EUR. But how could I think that Juventus will reach 1.80 EUR if it is already out of the Champions League? That's exactly what differentiates an investment from a bet, it doesn't matter that Juventus lost the match against Ajax because investing in Juventus means that you are projecting that the team will continue to improve over time. Moreover, the share price is not only based on football results, it depends on different factors such as the number of sponsors that are interested in the club or the amount of money the club is making from broadcasting the matches. For Juventus, for example, if it signs a world-class player in the future, this will likely increase the interest of investors, and therefore the share price will increase. Precisely, that's what happened when Juventus bought Cristiano Ronaldo, the share price soared to new all-time highs (see the video related to this article). Of course, there is a small chance that the share price never jumps back. In that case, you would have definitely lost your money, not all though, because in the stock market, it rarely happens that you lose 100%. To know what the actual outcome was with the shares that I had in my possession, i.e., Juventus and Ajax shares, I invite you to read the following article: "Forecasts from March 2019 to January 2021."

Afternote: In the long term, I lost money with Juventus and made gains with Ajax.

Views: 1 Sports

Notifications

Receive the new articles in your email