Considering an analogy with fiat currencies, we explain in detail why in the world of cryptocurrencies, altcoins follow the same trend of bitcoins. Moreover, based on concrete examples, we describe the fundamental analysis and its psychological consequence.

Considering an analogy with fiat currencies, we explain in detail why in the world of cryptocurrencies, altcoins follow the same trend of bitcoins. Moreover, based on concrete examples, we describe the fundamental analysis and its psychological consequence.

At some point you may have asked yourself this. why do all cryptocurrencies behave the same as bitcoins? Why is it that when bitcoin devalues or appreciates, immediately all the others do too? To answer this we will make an analogy with 3 fiat currencies in a hypothetical world...

A summary of this article with some extra data appears in the following video:

Let's consider 3 countries and their respective currencies: France - Euro (EUR), United States - Dollar (USD) and Egypt - Pound (EGP). Imagine that these countries developed their economies by isolating themselves from others. They were happy like that until one day an American crossed the Atlantic and arrived in Paris, then a Frenchman did the same and arrived in New York. Over the months many crossed from one country to the other to the point that trade relations between the two countries arose. What consequences does this bring? Well, it will be necessary to create an exchange rate between dollars and euros so that commercial relations can materialize. This is defined by the market itself based on the laws of supply and demand. To understand it, let's consider that a product costs 100 dollars in the United States and let's assume that a French person wants to buy it but has no dollars in his pocket, therefore, he will offer euros, let's say he offers 90 euros. The seller will make the decision to accept or not accept said euros in exchange for the product, for this he will possibly analyze how much he can do with 90 euros if he travels to France or if someone else will be able to accept 90 euros in exchange for 100 dollars. If he considers that 90 euros is fine and the risk of losing is low, he will accept it and immediately the exchange rate will change to 100 dollars = 90 euros, or rather, 1 USD = 0.9 EUR. This is given considering one product and two people, if there are more products and more people, the analysis is similar, only the process is more complex.

Consider now that something similar happens between France and Egypt, i.e., a Frenchman and an Egyptian cross the Mediterranean Sea; therefore, an exchange rate arises between both countries, let's say it turns out to be 1 EUR = 15.0 EGP. In this story we will assume that because they are so far from each other, there is no direct relationship between the United States and Egypt, that is, there is no USD/EGP exchange rate. What if an American decides to travel to Egypt with dollars? It is very likely that his banknotes are worthless despite the fact that the USD / EUR exchange rate reflects that it has a value very similar to the euro. Think about it, imagine that a tourist from Sri Lanka arrives in your city and wants to offer you his coins in exchange for a product, would you accept? Do not! Because his currency is of no use to you even though it has a definite rate in the world. For it to work, there must be a commercial relationship with that country. And not only that, the commercial relationship must be strong since said currency must be used to do things in your country. So, going back to the initial example, the American will be forced to use the euro as an intermediary to buy Egyptian products, that is, he will first have to exchange his dollars for euros and then in Egypt exchange those euros for pounds. What consequences does this bring?

Let's imagine that the euro becomes weak against the dollar. How does this happen? Remember that everything is based on the laws of supply and demand. If the euro is no longer desirable in the United States then there will be less demand for it, therefore its price will fall. This can happen, for example, because French cheese is no longer desirable, so no one will try to get the euros to buy it. Let's say that after a while 1 USD = 1 EUR, that is, the dollar has appreciated and is now worth the same as the euro. What about the Egyptian pound? If trade relations remain constant between France and Egypt, the exchange rate from euros to Egyptian pounds will remain the same, 1 EUR = 15.0 EGP. It seems that there are no problems here, but really Egypt is hurt because since the euro has been devalued against the dollar, now it will cost much more for an Egyptian to buy an American product. Remember that for an Egyptian to access US products they will first have to change their coins to euros because direct exchange to dollars does not exist, e.g., if before they used to change 1350 EGP for 90 euros to access a 100 USD product, now they will need to buy 100 euros to access the same product, that is, invest 1,500 EGP. In simple words, even though there is no direct relationship between the United States and Egypt, if the euro falls against the dollar, the Egyptian pound indirectly also falls. This last sentence can already give you an idea of the behavior of altcoins against the dollar, if bitcoin falls against the dollar, indirectly the altcoin also falls. Precisely, as we can see in Fig. 1, altcoins behave like Egypt and bitcoins like France, because the altcoin market has no direct contact with the United States, or rather, with the dollar.

How is it possible that altcoins (ALT) do not have direct contact with the dollar or the conventional currencies of the world? It turns out that the first cryptocurrency to appear on the market was bitcoin (BTC) and it did so in 2009. More details about the origin appear in the article: "The past and future of bitcoins. Mathematical history". Therefore, in 2009, the laws of supply and demand generated the BTC/USD relationship, as happened in the previous example between France and the United States. When new cryptocurrencies emerged, today collectively called altcoins, the platforms that offered them only accepted to sell them in exchange for bitcoins, they did not accept dollars. Why? To avoid problems. Accepting dollars involved more legal paperwork, plus one could not glimpse at that time the potential that these new cryptocurrencies would have. In this way, the ALT/BTC relationship emerged as it did in the previous example between Egypt and France, but the ALT/USD relationship (≡ EGP/USD) was not present directly.

This is the fundamental reason why all cryptocurrencies behave similarly to bitcoins. As an example, let's look at Fig. 2:

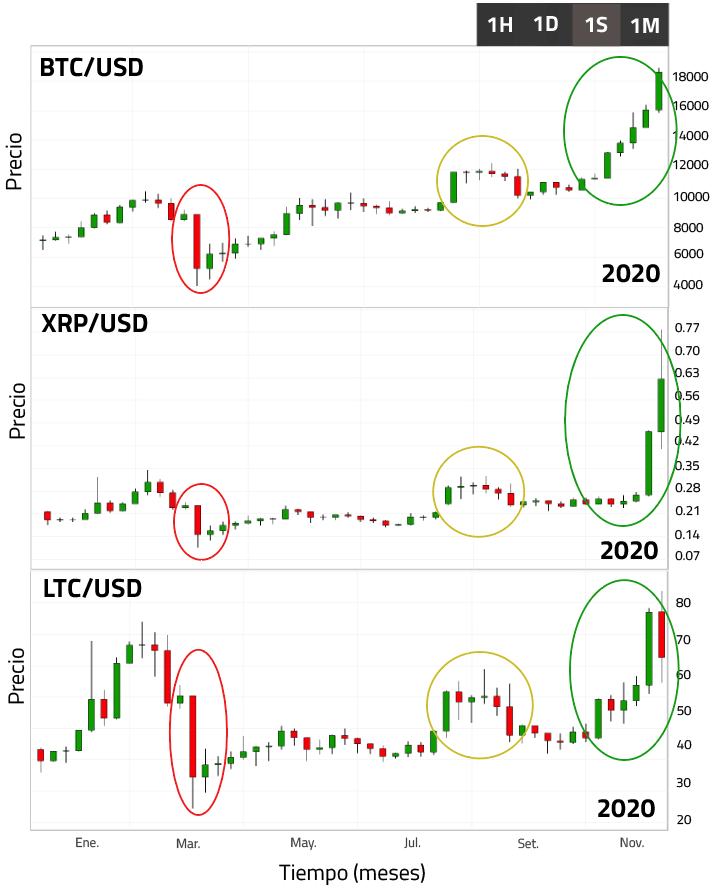

The upper graphs represent the evolution of bitcoins and altcoins in 2020. For the latter I only consider litecoins (LTC) and XRP. As you can see, we have:

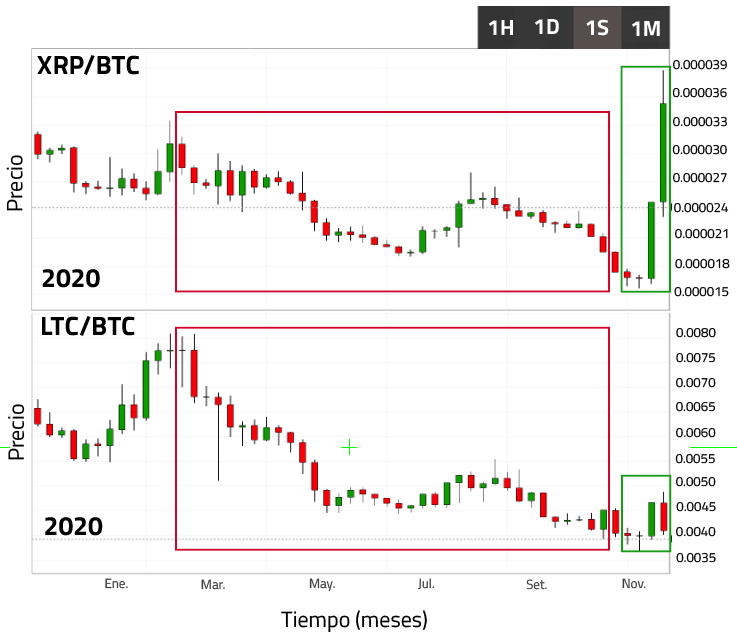

Bitcoins and altcoins behave exactly the same, to the point that the three currencies, BTC, XRP and LTC draw the same candles touching new highs at the end of 2020. That is why the ALT vs USD charts are not very important and when one studies altcoins it is always recommended to study them versus bitcoins. Below we see these charts for XRP and LTC:

As we can see in Fig. 3, with respect to bitcoins, both altcoins suffer a continuous fall until the end of October (red rectangle). It is in the month of November that both cryptocurrencies grow (green rectangle), but XRP does so much more, to the point that it manages to hit an annual record.

At this point in the article you can possibly question the analysis by arguing that today there are already platforms that allow you to buy altcoins with dollars and therefore the analogy I mentioned would no longer apply in these times. Indeed this is true, today there is already a direct relationship ALT / USD; however, there are three important points to note to understand why this is irrelevant: i) The big investors of yesterday bought many altcoins with bitcoins and therefore they are the ones who control the altcoin market and decide the fate of the same. ii) The exchange platforms with the highest density of investors today still do not accept dollars to obtain altcoins, that is, the direct relationship does not yet play a determining role and that is why we cannot appreciate the independence of an altcoin against bitcoin . iii) Large investors are aware of the economic rules of the market, and in particular, of its origins, therefore, they have been dragging these ideas over the years. This means that the psychological factor plays an additional and perhaps the most determining role. To understand this, let's imagine that at this very moment bitcoin is experiencing explosive growth against the dollar. Would you buy altcoins or not? In the analogy I told there is a fundamental reason to assume that altcoins must also grow, but this analogy focuses on describing the origins of the altcoin market, would the market of those times still be valid in these times? Technically no, but since investors in the past continuously applied this investment method, today everyone takes it for granted and it doesn't matter if there is a solid foundation behind it. As you can see, over time, this becomes something psychological, and that is why altcoins react the same to the explosive changes of bitcoins, of course in the real market the reaction is instantaneous because the great investors do not invest with their fingers but with programmed algorithms that process this information in less than a second. In this sense, while one can be sure of the trends that altcoins will take, many will not be able to take full advantage of it because these fluctuations move at super speed... Keep in mind that I focus on explosive changes, if the fluctuations are not explosive the behavior of altcoins can detach from the behavior of bitcoins, but this only happens in short intervals in time. This is explained in more detail in the article: "How to hedge or boost your bitcoin gains considering altcoins."

To conclude, one last question remains to be answered: "In how long could we see an altcoin break away from the bitcoin trend forever?" Possibly never, or at least not in the short term because bitcoins to date have market dominance, that is, many investors buy bitcoins over altcoins, and only when an altcoin monopolizes the new investors of the future will we only be able to glimpse this chimera, and I call it that, because for this to happen, that altcoin must be much more revolutionary than the concept of bitcoins and that to date no altcoin has proven it; however, it is important to know that each season certain candidates appear, which achieve a certain independence in their peak periods. What are these altcoins? I recommend that you discover them yourself.

Views: 1

Notifications

Receive the new articles in your email