Considering graphs of the cryptocurrency price vs. time we show that link behaves as a hedge and litecoin behaves as a pressure booster. We define these terms and explain how to increase your bitcoin earnings using these altcoins.

Considering graphs of the cryptocurrency price vs. time we show that link behaves as a hedge and litecoin behaves as a pressure booster. We define these terms and explain how to increase your bitcoin earnings using these altcoins.

In the article: "Forecasts from March 2019 to January 2021" I showed that my credibility in the financial world is 90.5%, because I was right in 19 predictions and wrong in 2. Of those 19, there was one that I did not explain, which was shared on December 28, 2020 on my Twitter account:

In this article I will explain this prediction, which appears in Fig. 1; in particular, we will understand "why link behaves as a hedge and litecoin as a booster?" A summary of this article with some extra data appears in the following video:

In finance, hedging refers to the set of actions or events that reduce the risk of an investment. While in hydraulic engineering, a pressure booster is a device used to generate more momentum in a fluid through a distribution network. So what I tried to say on December 28 is that by investing in link one could reduce the risk of losing money by investing in bitcoins. While investing in litecoin, one could get more momentum and thus earn more profit. In this sense, when the fluctuation of bitcoins is ascending (bull market or bull market in English, represented by the bull in Fig. 1), it would be convenient to invest in litecoin because it behaves as an increaser of pressure. On the other hand, when the fluctuation is downward (bear market or bear market in English, represented by the bear in Fig. 1), it would be convenient to invest in link because it behaves like a hedge.

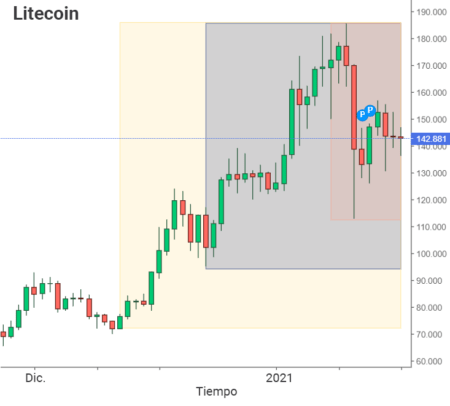

If you are a little confused with the given definitions, that's no problem because we will then answer if my prediction was correct and by doing so everything will become clearer. For this, consider the following image:

In Fig. 2 we are seeing the price fluctuation of bitcoins for the months of December 2020 and January 2021. The yellow box starts on December 12, the blue box on December 23 and the red box on December 8. January. These boxes represent respectively for those dates, the beginning, the continuation and the end of the bull market, so if we say that litecoins behave as a pressure booster, we can infer that in the bull period, that goes from December 12 to January 08, litecoins are destined to grow more than bitcoins. Similarly, if we say that link behaves like a hedge, we must infer that in the red box, link is destined to grow to compensate for the stagnation of bitcoins...

As you can see in Fig. 3, what we just inferred was completely fulfilled. From December 12, 2020 to the highest peak of bitcoins, given on January 08, 2021, litecoins grew over 150%, while bitcoins only approached 130%. In contrast, link in that same period only grew 50%, but when bitcoins stopped growing after January 08, link skyrocketed from the value of 14 USD to the value of 23 USD, that is, a growth of over 60 %. These behaviors, interestingly enough, happen all the time, but why do these cryptocurrencies behave like this? In order to answer it, I would first like to clarify two important points. The first is associated with the article: "Why do altcoins behave the same as bitcoins against the dollar?". If you read this article you will notice that by saying that the link behaves like a hedge, it contradicts that altcoins behave the same as bitcoins against the dollar; however, this is just a misunderstanding because in that article I only talked about explosive movements, that is, when bitcoins grow abruptly or suffer a gigantic collapse, then altcoins will immediately react the same. This can be seen by comparing Figs. 2 and 3. For example, when bitcoins plummeted sharply, on those same days, link and litecoin also plummeted sharply. It is in the days following this sharp change that link and litecoin adjust their trends, the former is more suited to the behavior of bitcoins, while the latter is likely to explode as a hedge. This is because after the psychological scare, investors migrate to altcoins and therefore trends detach from bitcoins. The second point to clarify is regarding the frequency in which events occur. I have mentioned that these behaviors occur all the time; however, that is not why one is always destined to win, because in a financial market cycles tend to change, that is, even if there are events with trends that come to pass, in some cases they will not, and it is even possible that over time cease to exist. In this sense, the objective of this article is to show you a personal analysis that is very valid but is not without errors.

With these points clarified, we proceed to answer the question: Why does link behave as a hedge and litecoin as an increaser? What's so special about them? The truth is that they are not very special because they are not absolute, that is, probably other cryptocurrencies had a better performance than these two. If I mention them here it is because they belong to my investment strategy and I understand them more than all the others. In this sense, the following assessment is purely personal... Litecoin grows in a bull market because it is the oldest altcoin. Some may say that it is not so because there were others before; however, those others no longer exist today, so litecoin is the oldest still alive. It was created in 2011 and as I mentioned in the article: "Why do altcoins behave the same as bitcoins against the dollar?" , at that time there was no ALT / USD relationship, which implies that to obtain litecoins one had to buy them using bitcoins. Because of this, the ALT/BTC relationship became so close that the behavior of litecoins against the dollar was nothing more than a reflection of bitcoins against it. Over the years, new cryptocurrencies emerged, but these never surpassed the close relationship of litecoins because this relationship only became stronger with the years of existence. In this sense, litecoins over time have become the first cousins of bitcoins and therefore every fluctuation of bitcoins will be imitated by litecoins, and why do they grow more than bitcoins in a bull market? Well, the truth is that in a bear market the same thing happens, litecoins fall much more than bitcoins, and this is because volatility is associated with the price of the cryptocurrency. If the cryptocurrency is worth a lot, it will have less volatility, but if it has a small value, it will reflect a high fluctuation. They are just mathematics that are appreciated on percentage scales. For example, if cryptocurrency A is worth 0.1 USD, growing to 0.11 USD is already 10% growing. And if a cryptocurrency B is worth 10,000 USD, for it to have the same percentage growth it should increase by 1,000, that is, investors must be able to invest 1,000 dollars, in contrast, in the first, it is enough to add 0.01 dollars to reach a high growth...

Regarding link, the story is different. In the universe of cryptocurrencies there is a messianic prophecy that indicates that in the future a new bitcoin will emerge that will be born from the group of altcoins and will change the course of history. This new bitcoin will be so original that everyone will seek to have it and therefore invest all their money in it, which would eventually imply that the price of that bitcoin would reach colossal values. As it is not possible to know which one it will be, candidates arise every season. In 2017, the concept of DeFi (Decentralized Finance in English) appeared with force and with this concept a group of altcoins emerged whose purpose was focused on decentralizing finance, because although bitcoins are translated into storage and transfer of digital money in a decentralized way, the financial world is more than that and also includes contracts, loans, derivatives and many more. In case you are lost on this topic, in the third video associated with the article: "The origin of bitcoins. Complete explanation for beginners" , I explain in a very simple way how to generate a contract using the block chain. In this sense, if we managed to decentralize all the variables of the financial world, life would be completely different. For this reason, many investors consider that DeFi altcoins are the bitcoins of the future, so every time bitcoins stop growing against the dollar, these investors choose to migrate their investments to those altcoins, and therefore behave as a hedge. Of all the DeFi cryptocurrencies in circulation, link is my favorite, but explaining why would imply getting into the technical part and it is better to leave that for another opportunity because in the end the purpose of this article was to reaffirm my 90.5% credibility.

Views: 1

Notifications

Receive the new articles in your email