W-8 BEN form

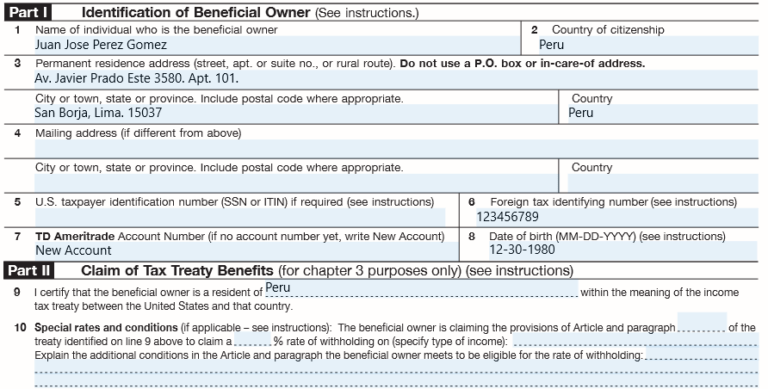

The W-8 BEN form is the easiest to fill out. As an example, let's consider that your name is Juan Jose Perez Gomez. You live in Peru, you have a Peruvian nationality, and you were born on December 30th, 1980. In this case, you fill out parts I and II of the form as follows:

As you can see in Fig. 1, there are blank spaces that you don't have to worry about filling. For more information, contact TD Ameritrade. The most important point in Fig. 1 is the Foreign Tax Identifying Number (FTIN). You should contact the government entity in your country that is in charge of the capital gain taxes to get this number. For example, in Peru this institution is known as SUNAT, and the FTIN number is known as RUC. Nowadays, of course, it is likely that you can request this number online. For example, in Peru, you just type "RUC Peru" in Google and the first page takes you to the website of SUNAT.

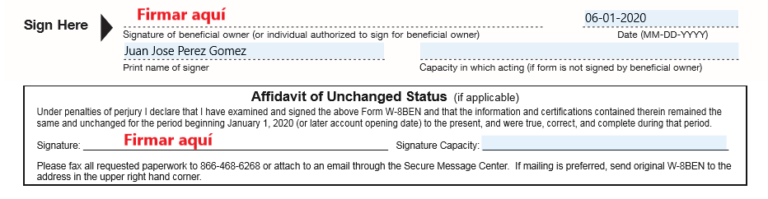

In Fig. 2 I show you how the RUC webpage looks like. There, you only have to type your identity document number (DNI in Peru) and the system will grant you the associated RUC number. In case you don't have one, you have to request it in person and tell them that you need one because you are planning to invest in the stock market. They will give you the number and all what is left is to write it down on W-8 BEN form. Finally, you will complete the form by signing it as it appears in Fig. 3:

To get information about how to fill the second form, click on "Application," otherwise, to return to the 6 steps to create an account in TD Ameritrade, click on "Main."

Views: 1

Notifications

Receive the new articles in your email